Riding S-Curves

How AI is changing Series A outcomes in 2025

What is happening with Series A’s today in software companies?

This is the question I’ve found myself discussing with founders and investors repeatedly this summer. If you work in the startup ecosystem and feel like the market for Series A’s is unpredictable right now, that’s because it is.

Some startups are landing large A’s with less-than-typical metrics, while others with better numbers are raising smaller rounds. Seeds are regularly clearing $20–25M valuations, yet the median A is still valued at ~$40–60M, and we’re seeing the emergence of a new tier of ~$100M+ A valuations.

In this post I explore what’s driving these changes at the Series A, and how software startups can adapt.

AI killed spreadsheet investing

Early-stage investors traditionally evaluate a potential startup investment based on three pillars: The founder, the market, and the product. Different venture investors have different ways of prioritizing these criteria. Metrics like growth and retention are a fourth pillar, if the startup has them.

The 2010-2021 software wave saw the standardization of investment patterns in startups. SaaS investors had clear visibility into markets due to established trends, well-defined competitive landscapes, and consistent business models like subscription pricing, predictable customer acquisition costs, and measurable retention metrics. This allowed investors to rely heavily on pattern matching, historical data, and well-defined market sizes in known categories of software. I wrote a bit about this from the founder’s perspective in my last blog post.

But in the last few years, AI has emerged as a defining technology that software investors firmly believe has the potential to disrupt existing categories of software, and create many new ones. Historical pattern matching, growth benchmarks, and market sizing exercises have become far less valuable, and in many cases have been thrown completely out the window. Victor Lazarte summed this up on the 20VC podcast as “spreadsheet investing is dead”.

All of this has led to a fundamental shift that many in the startup ecosystem haven’t internalized yet: A startup’s market has become the most important determinant of its ability to raise early-stage venture capital.

Markets & S-Curves

S-curves define technology adoption in new markets. When a new technology like the smartphone is released there is a gradual experimentation phase where early adopters begin to try it out. Then adoption takes off, with the technology becoming rapidly ingrained in society - the steep part of the S-curve. Finally growth plateaus as adoption becomes saturated and everyone has the technology. From the printing press to the internet, nearly every technology’s adoption follows an S-curve.

For investors and entrepreneurs, the most exciting part is the exponential part of the S-curve. ChatGPT has been experiencing this phase of growth for the last two years. This is when new markets are created. As Peter Thiel talks about in Zero to One, the greatest opportunity in starting a new business is taking part in the creation of a new market, like his famous investment in Facebook did in social media. Apple did this with smartphones, Microsoft with the personal computer, and Uber with ride sharing. When a company is aligned to the creation of a new market, it has the opportunity to escape competition and establish market dominance. If the market is large enough, this is where businesses with 100-Billion or 1-Trillion dollar valuations get created.

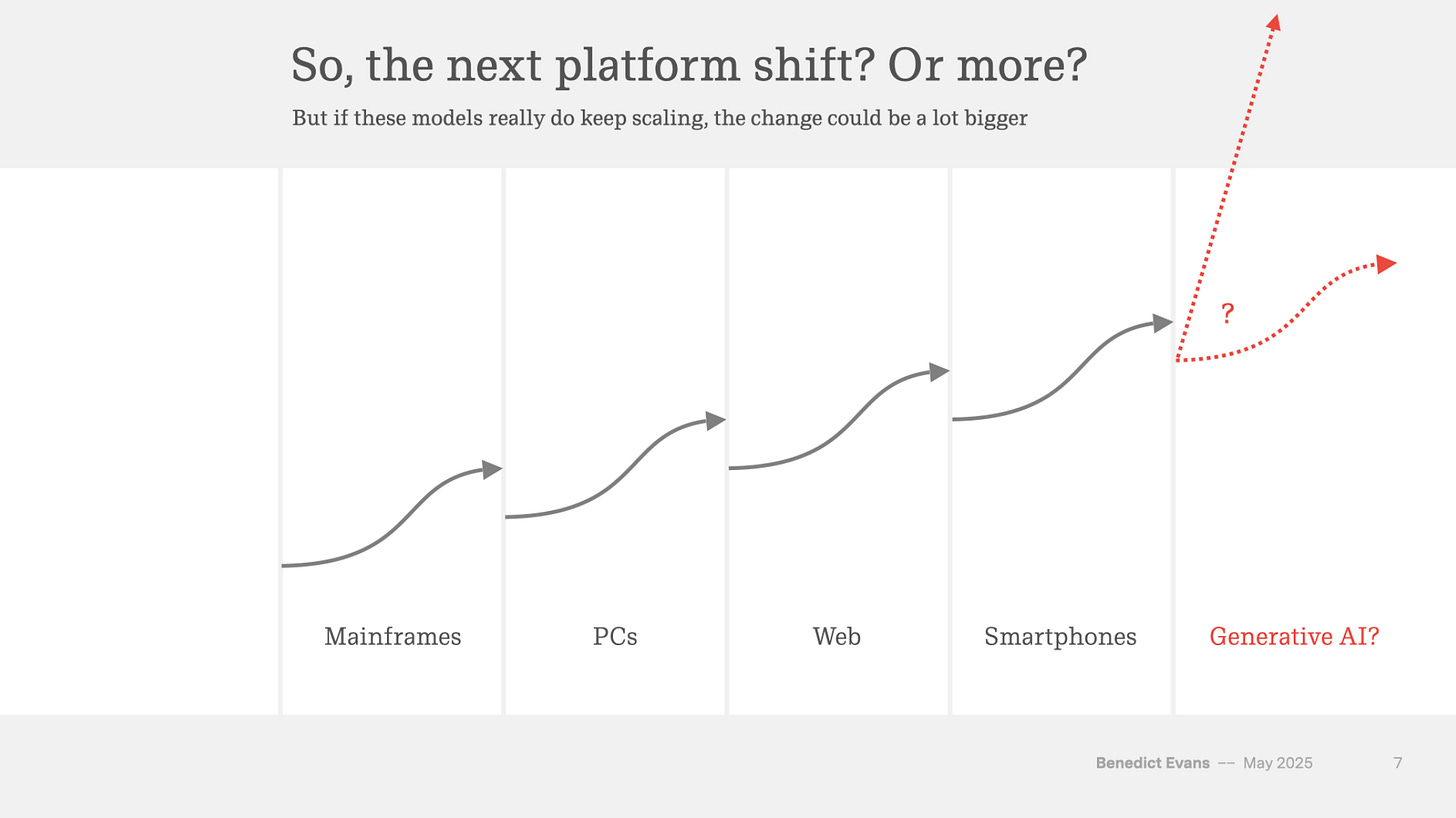

The above slide is from tech industry analyst Benedict Evans, from his AI Eats the World presentation. He represents the consensus view among investors, which is that AI is the next tech platform shift, and it will either be great for the economy, or the most economically productive technology of all time - either way, pretty good!

Suffice to say investors are excited. Every VC is on the hunt for this generation’s Uber or Facebook - the company that will define this tech transition. (Hint: The answer is OpenAI, but there will be others too).

That means for software investors, the questions they ask themselves when evaluating a potential investment are often AI questions: How will this startup’s market change because of AI? Will it grow faster because of AI, or get cannibalized by it? Will OpenAI, Anthropic and the foundation model companies enter this market? Does AI change customer expectations around what this product should be?

For founders starting AI companies, these questions matter at all stages, but where it matters most is at the Series A.

Series A’s, They Are A-Changin

At pre-seed and seed, investors bet on founders and the problems they aim to solve, even if the product specifics remain fuzzy. By the time a company gets to Series B and beyond, financial metrics play a larger role in assessing a potential investment - great companies can start to look obvious.

But most Series A’s represent a unique moment in a company’s journey. They (typically) happen only a few months or quarters after a startup reaches product-market-fit. A lot can still go wrong, and investors often have around a year of metrics to consider. Unless growth is explosive or the founder is already well known, then investors are going to focus on the company’s market, the market’s growth, and the company’s ability to be a leader in that market.

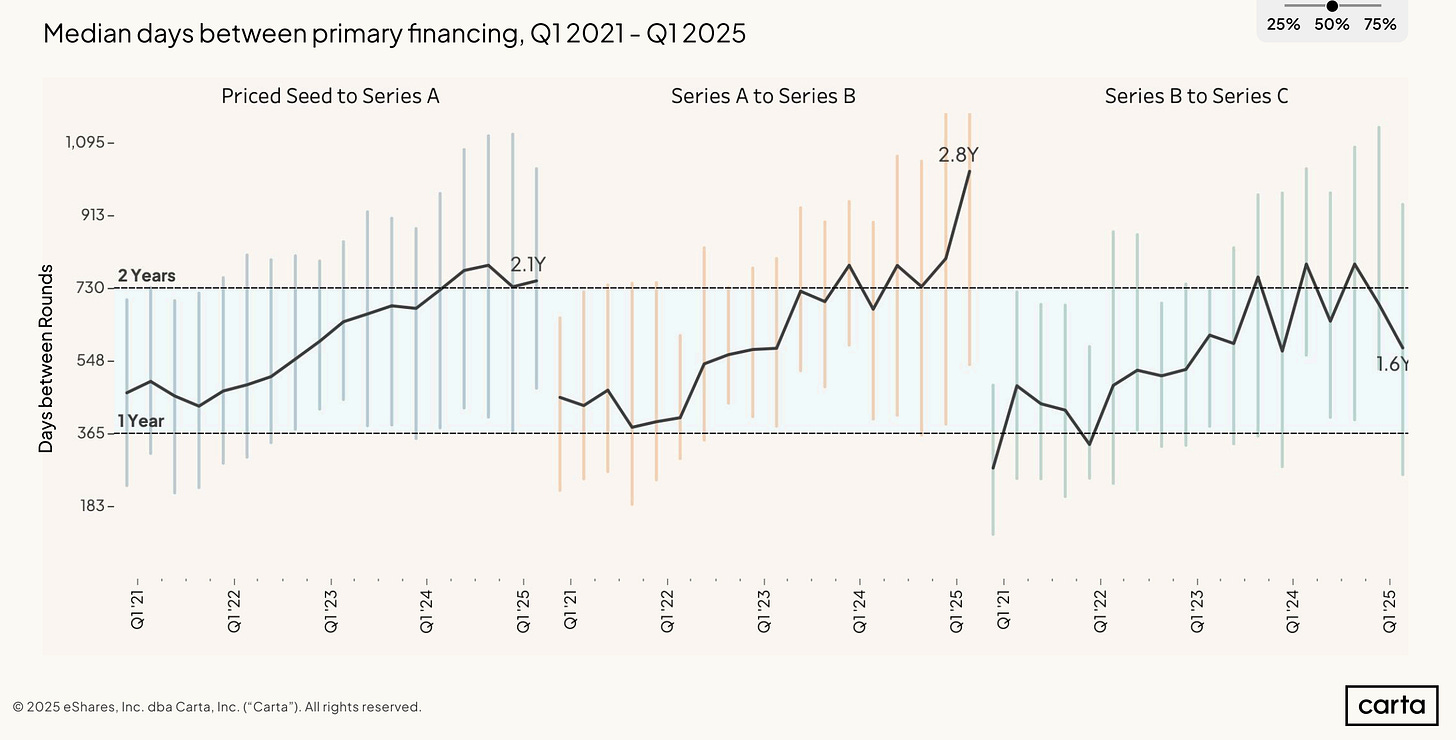

Simply put, at the Series A, investors want to see that a company has the potential to be a market leader. But not every company has the potential to be a category-leader, and as the chart show below, startups are taking longer to raise series A’s.

But that above chart is the median startup.

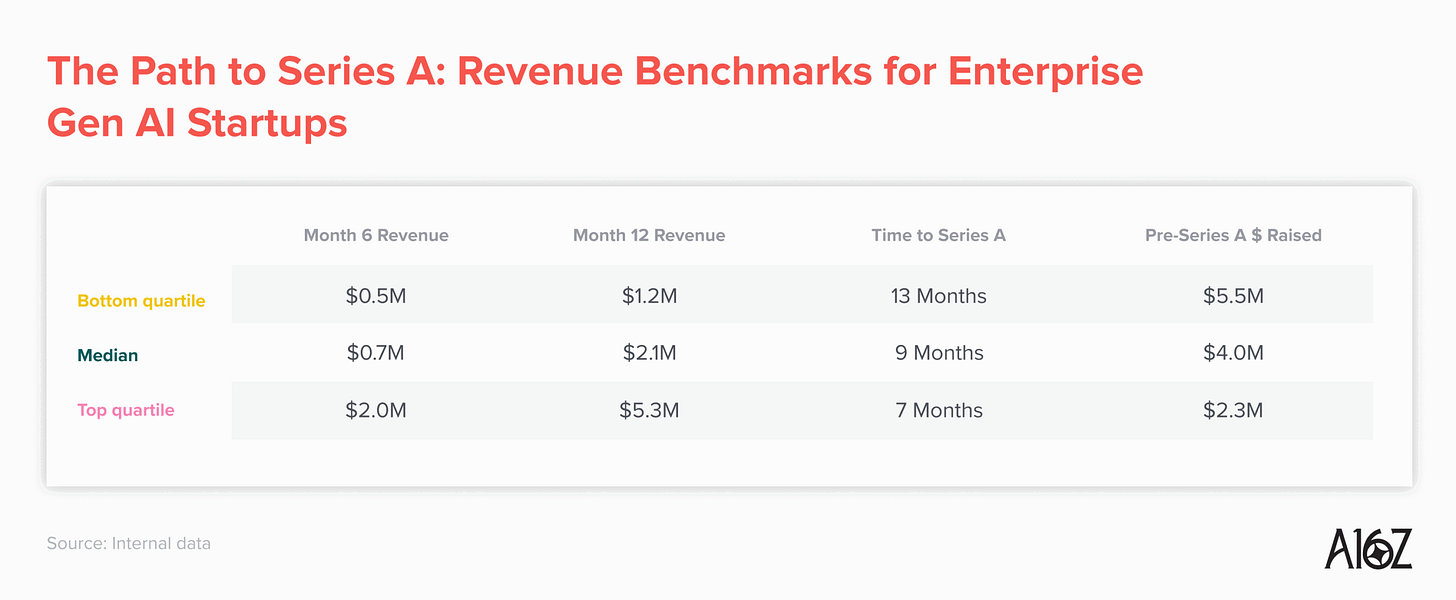

AI startups are a different story. They are raising Series A’s faster, and doing so with better metrics than investors are historically used to seeing at the Series A. Last month Andreessen Horowitz, one of the top venture capital firms, published a provocative blog post called What “Working” Means in the Era of AI Apps, which shows the current cohort of AI-native software companies are setting a new standard of expectations for pre-Series A growth.

For software companies, going from zero to $1M in ARR in the 12 months following a company’s first customer contract used to be considered the standard benchmark for what “good” looks like before raising a series A. Now, at least according to a16z, that is bottom quartile, and the median is zero to $2M in 12 months.

Takeaways for Startups

For companies at the Series A, there are increasingly two types of rounds.

Standard Series A: $12-15M

Credible team, good metrics, and a clear market opportunity

Mega Series A: $25M+

Strong team, strong metrics, and significant category-defining market opportunity catalyzed by AI

Let’s consider some of the anecdotes from Mega Series A’s so far this year:

OpenRouter - $40M (Seed + A) led by a16z, Sequoia

AI middleware that enables developers to seamlessly use different LLMs in their application

Campfire - $30M led by Accel

AI-driven ERP system

Greptile - $30M led by Benchmark

AI-powered code review

Wispr Flow - $30M led by Menlo

AI speech-to-text tool that allows users to talk into any app on their computer

Listen Labs - $27M led by Sequoia

AI-powered voice surveys for market research

Rillet - $25M led by Sequoia (just announced their Series B this week only 2 months after their Series A)

AI-driven ERP system

Assuming the typical 20% dilution, these are companies being valued well over $100M.

What Mega Series A’s all have in common is a very clear story around how their company has the potential to create and define an AI-native category of software. They can explain:

Why Now: Why is this category inflecting or emerging because of AI right now?

Budgets: How will you win spend from incumbents, or how will you create entirely new budget lines that fund your customer contracts?

Competition: Will the foundation model providers enter this space, and if so how will you compete against them?

Model Improvement: How does the march of better/faster/cheaper models make your product meaningfully better over time?

Distribution: How will you build an initial customer base and then scale it over time?

Proprietary Data Loops: How does user/customer data make your product experience better for customers over time

Market Awareness/Pull: Is your target market actively searching for a solution, or will you need to educate and evangelize?

Raising a Series A for a software startup in 2025 is equally about great numbers as it is telling a great story that aligns the company to what many investors believe will be the biggest platform shift of their careers.

The numbers still matter, but the story is the difference maker.

The best Series A companies are making a clear, compelling case for why their category is being reinvented and why they’ll lead that reinvention. Software startups have to articulate how their market is being transformed by AI, positioning themselves ideally as the catalyst driving that change. Telling that story and finding investors who share in its vision has never been more important.