Compounding Belief

How founder cults become competitive advantage

In 2015-2016 Tesla was consistently among the top 5 most shorted stocks in the US. Roughly 20-30% of the company’s stock at any given time was held by short sellers, including by some of the most legendary short sellers of all time like Jim Chanos and David Einhorn. Tesla’s executives were leaving, traditional automakers were building their own electric cars, the Tesla Model 3 faced production delays, and Tesla’s questionable unit economics and lack of profitability all contributed to a sense that there was a real chance Tesla could go out of business.

They were right. And yet, the trade didn’t work. Tesla’s stock went up ~14x between 2017-2020. The bears lost many fortunes and in some cases shut down their funds.

Why? Many reasons, including Tesla’s compelling cars, direct-to-consumer distribution, global factories, and mission-driven brand.

But underlying all of that was one thing - Elon built a cult of personality around himself.

In fact, Elon was so successful at this, that “building cults” has become a bit of a meme on X/Twitter and in the startup community more generally.

Marc Andreessen was recently on the Cheeky Pint podcast and said:

“The Elon method…, which is becoming more and more salient, I think. And something we’re trying to get our founders to do a lot more of is ‘I’m going to become a cult of personality’. And it’s going to be a cult of personality, not just inside the company, but outside the company. And we’re not going to spend any money on marketing. We’re not going to put any time into IR. We’re going to put on the greatest show of all time and the company and the stock, the books, the videos, the products, the jobs are all a function of the cult of personality.”

The Elon method of “building a cult” translates belief into a corporate asset. The result is lower marketing costs, lower capital costs, and better access to talent.

But how? And can anyone else actually do this besides Elon?

Let’s dive in.

Storytelling as Capital

Elon Musk - by speaking in public about his mission and his struggles - created a following of believers who bought Tesla stock. They held through thick and thin - even through 2018 when cash dropped below $2B, and nearly bankrupted Tesla before it could see through to the Model 3 sales ramp.

Its dedicated shareholder base enabled Tesla to raise $18.5B in equity between 2015-2020. The capital was a lifeline that got the company through what Elon called production hell. In 2019 the Shanghai Gigafactory launched, and in 2020 Tesla printed four straight quarters of profitability and was included in the S&P 500.

5 years later, Tesla continues to defy the gravity (low P/E multiples) that would pull down most car companies. Tesla’s price-to-earnings multiple on 2025 earnings is 217x vs. Ford at 11x and GM at 6x. With a $1.4T market cap, it is the 10th most valuable company in the world - just ahead of Warren Buffett’s Berkshire Hathaway.

Elon was the first modern CEO to rewrite the boundary between product and story. CEO’s have taken heed.

The Elon model - of building in public, creating a spectacle, using social media and the press to speak directly to the public and investors, and convert belief into cheaper capital and distribution - has now become the playbook followed by many leaders in tech.

But who besides Elon is actually running that playbook?

Dr. Karp

Palantir trades at 114x 2025 revenue estimates. The next most expensive software stock is Cloudflare, which trades at 36x, while the median high growth software company trade at 14x (high-growth being defined as growing revenue over 20% this year).

To put that in perspective, Palantir’s $470B market cap is worth more than Salesforce and Adobe combined despite having $4B in annual revenue compared to Salesforce’s $41B and Adobe’s $24B.

Don’t get me wrong - Palantir is an incredible business. It is the only major publicly-traded software company expected to grow revenue over 40% this year, making it the fastest growing software stock AND has scaled free cash flow margins of 45%.

But the numbers don’t explain the valuation premium, so what does?

Dr. Alex Karp, Palantir’s CEO1 .

In the last few years since Palantir went public in 2020, Karp has shifted his public persona from a quiet, if eccentric, bookish intellectual - to an aggressive and energetic philosopher warrior. Nowhere is that contrast starker than in this 2009 interview on Charlie Rose compared with this 2024 interview on CNBC.

Karp, through sheer force of his personality, has built an investor base that believes Palantir is not just a data integration and analytics platform with an effective go-to-market strategy that can win large government & enterprise contracts. Rather, they believe Palantir is at the frontlines of the West’s battle against authoritarianism.

Aside from positioning Palantir at the center of an existential battle of good and evil, Karp is also funny. He’s entertaining, and unquestionably himself - authentic.

That blend has created a cult following among Palantir’s investor base that has propelled the company to the second most valuable enterprise software company in the world, only behind Oracle.

Palmer

It’s not just Elon & Karp.

Palmer Luckey is clearly running a similar playbook at Anduril. He talks about it here, explaining the difference between merely growing follower count on social media, and building a cult following among people who matter.

“I like to see the growing follower count as a side effect of the larger strategy. It’s okay if they think you’re a little nuts, a little out there - that’s okay. But they can’t think you’re immoral. They can’t think you’re not credible. They can’t think you’re incapable. It’s okay if they question your style, but the substance has to be there.”

Palmer’s core belief in founding Anduril was that the US military was falling behind in innovation, and failing to integrate modern technology into defense would lead to a West that was vulnerable to hostile players abroad. The artifacts of that belief are not just the cutting-edge products like an unmanned fighter jet named Fury, but Palmer’s ability to talk about it everywhere from mainstream outlets to 60 minutes to Joe Rogan, where he recently went on to talk about Anduril’s new AI-powered helmet, EagleEye.

The Information recently called Anduril “the most coveted stock in the private markets”, with the stock trading at a 2x premium to the round done last June, which was at a $30B valuation.

Now Palmer is going to run it back in a new industry - banking - with Erebor, the new tech-focused bank where Palmer serves as chairman of the board and is the main shareholder.

The Founder Cult Flywheel

A company is, in many ways, a manifestation of the beliefs of its founder.

Tesla was founded out of Elon’s belief that society needed to accelerate its path toward sustainable energy. Palantir was founded on the belief that the West needs superior technology to secure its freedom. Anduril was founded on the belief that the US’s military is falling behind and needs modern technology to protect America in the 21st century.

But it’s not just them - I could write a much longer post talking about what Vlad Tenev at Robinhood is doing, Sam Altman at OpenAI, Dario Amodei at Anthropic, Patrick and John Collison at Stripe, Jensen Huang at Nvidia, and the list goes on.

Founders who can put their beliefs out into the public, and elevate their company’s mission to the most ambitious version of itself have the potential to create a sustainable competitive advantage.

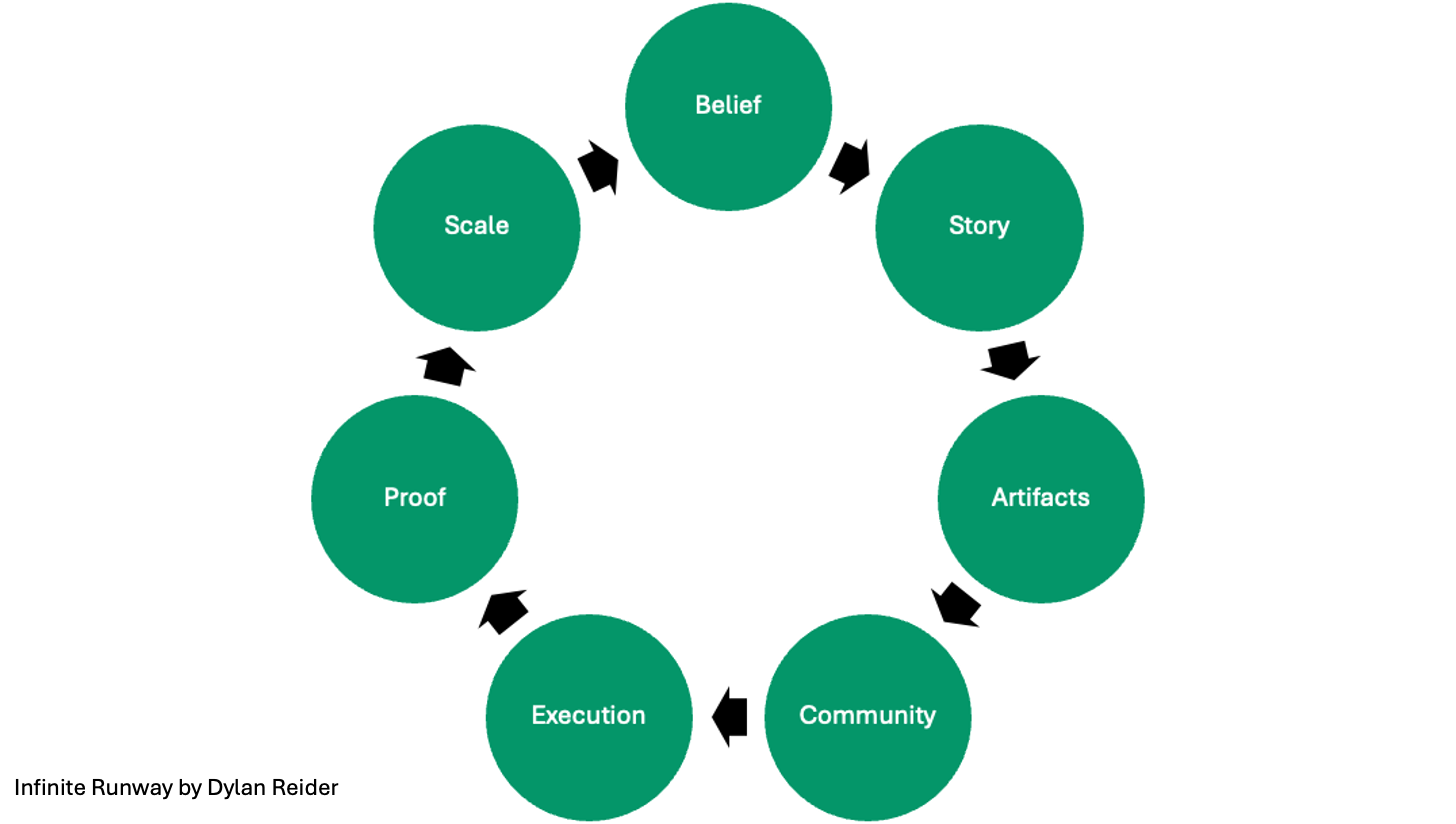

Here’s how it works:

It starts with the founder’s belief, framed as a story with high stakes, and if possible an existential enemy.

The story is manifested into artifacts - products, ads, CEO letters to investors.

Those artifacts create a community who identify with them. Customers, investors, employees, partners, and the broader public.

The presence of that community reduces transaction costs across the business. Lower customer acquisition costs, cheaper capital, better talent, and pricing power - all should lead to strong execution.

Execution produces results - proof the community needs to strengthen their conviction.

Scale reinforces the founder’s story, garners more believers, and the viral loop continues.

The market rewards founders who can convert storytelling into operational leverage.

Operational Leverage

Despite me using the phrase throughout this post, I honestly think “building a cult” has become a meme, and a bit a cringey.

However, the reason it has become a memetic, over-used idea is because it has a kernel of truth in it.

That truth is about the power that founders have when they generate deep belief in their company among investors, customers, partners, and the broader public.

Belief that goes beyond the numbers and the product - but rather to the long-term vision of the company.

Generating that level of conviction is about creating a feedback loop between story and execution. Story creates permission from the public. Proof renews their belief with greater conviction. When done right, belief can lower the cost of distribution, capital, and talent. It ultimately can compress the distance between vision and execution, the future and the present.

“Building a cult” is how founders convert story-telling into operational leverage, which can become a competitive advantage. Which in the current age of AI, abundant capital, and existential questions about how companies succeed in the future - is something we’re all looking for.

*Disclaimer: After fielding some questions about whether I’m justifying Palantir’s valuation - to be clear, I’m not - my point here is not that Palantir’s valuation is justified by Karp’s aura. It’s entirely possible Palantir’s valuation compresses 70–90% if the stock market turns. That wouldn’t disprove the point. A cult-driven multiple isn’t necessarily permanent, nor is it a moat, but it does buy time for a company to drive execution with lower transaction costs.