Netskope's S-1 Breakdown

A scaled security & networking leader

Netskope was founded in 2012 to solve new cybersecurity threats that were emerging with the rise of the cloud. Last Friday Netskope filed it’s S-1, a legal statement to the SEC that a company makes before it goes public. Today we’ll dive into the S-1 and cover Netskope’s founding story, product suite, go-to-market strategy, metrics, and more - plus where I think Netskope will likely trade when it goes public.

Before diving in though, I want to highlight that in many ways, the story of Netskope and their decision to IPO at this point in the company’s lifecycle, is a reflection of the broader state of the capital markets in tech, and of many of the largest private SaaS companies.

Like many other SaaS leaders, Netskope started at the beginning of the 2010s, rode a massive wave with the rise cloud computing, and now have a full product platform that can compete with the largest companies in their category.

Now, the cloud wave that carried their decade-long growth run has largely played out. Netskope has matured - it is a market leader and is shifting focus to becoming profitable.

At the same time, a new market is breaking open with AI, which represents a new s-curve, shifting the market in such a way that threatens to displace mature companies like Netskope - the same way the cloud threatened legacy security providers over a decade ago. But that same threat is also an opportunity, if they can capture it.

So Netskope is going public as it embarks on its second act as a company - becoming profitable, maintaining category leadership against larger competitors, and navigating product expansion to address the AI opportunity.

It’s a similar story to other IPOs we’ve seen in the current cycle, and one we’ll continue to see. The same could be said about other privately-held SaaS leaders who are long overdue for an IPO, including Canva, Airtable, Miro, Snyk, Databricks, and many others.

To be clear, it’s better late than never! But it would be wonderful if we could get back to a place where tech companies IPO’d earlier and retail investors were able to participate the value creation that comes with being a shareholder in a company experiencing hyper-growth. Until 2021, that was the case, and software companies went public with anywhere from $100-500M in revenue.

Unfortunately, for many reasons I’ll cover in a future post, the capital markets have experienced a structural shift and the trend of companies going public later in their lifecycle will likely continue.

Netskope is still an incredible company and the tech industry should applaud their decision to go public!

With that, let’s dive in.

Founding Story

In 2011, Sanjay Beri was VP/GM of the Access & Security business at Juniper Networks. Juniper was a provider of networking hardware that was one of the darlings of the telecom/dot-com bubble - at the peak in 2000 it was worth $40B+ and itself was one of the best venture outcomes ever, but that’s another story (it was acquired by HPE earlier this year).

By 2011 Juniper was a steady, boring business selling hardware that powered corporate IT networks. The nature of those networks were changing to become increasingly defined by software rather than hardware - a shift that Sanjay Beri had a front row seat to.

As businesses were increasingly adopting SaaS, accessed via a browser, instead of traditional desktop software, old perimeter-based security solutions became obsolete. The idea of a “corporate network” shifted from a fixed location - an office with a server room, desktop computers, and wired internet - to anywhere. Corporate computing was starting to take place on mobile devices, tablets, connected factories, and anywhere with an internet connection.

Around the same time in 2011, Chamath Palihapitiya had just founded Social Capital, and recruited Mahmoon Hamid from US Venture Partners to be a general partner at his new firm. Mahmoon now runs Kleiner Perkins and is a top venture capitalist, but at the time he had only been working in venture for 6 years.

According to Mahmoon’s original blog post announcing the creation of Netskope, he and Sanjay originally met through Mahmoon’s wife - the two of them were classmates at University of Waterloo together. Mahmoon and Sanjay started talking about the future of cybersecurity in the cloud, and Sanjay’s desire to start a company going after the opportunity he saw.

In 2012, Mahmoon ended up leading Netskope’s seed round with $5.5M and incubating the company for the first 6 months at the Social Capital offices. Lightspeed followed with a $15.9M Series A in 2013 and the company was off to the races.

Product

Netskope’s first product was a cloud access security broker (CASB) which provided control and security over SaaS apps that employees could access. Any sensitive data being put into a SaaS app (or taken out of it) could be stopped in real-time by Netskope.

Since then, the company has expanded to offer security, networking, and analytics in a single platform they call Netskope One.

Netskope One is a product portfolio including over 20 individual product modules, broken down into three categories:

Security: Netskope watches and controls how company data moves across cloud apps, websites, and internal systems. Abnormal, high-risk behavior is stopped in real-time to ensure sensitive data doesn’t leak out of the organization.

Networking: Netskope built a network of 120 data centers in 75 regions globally to securely route its customers corporate internet traffic, removing the need for customers to have physical firewalls.

Analytics: Netskope unifies activity across users and apps into clear dashboards and alerts, so security teams can see what’s happening, fix performance hiccups, and prevent problems before they spread.

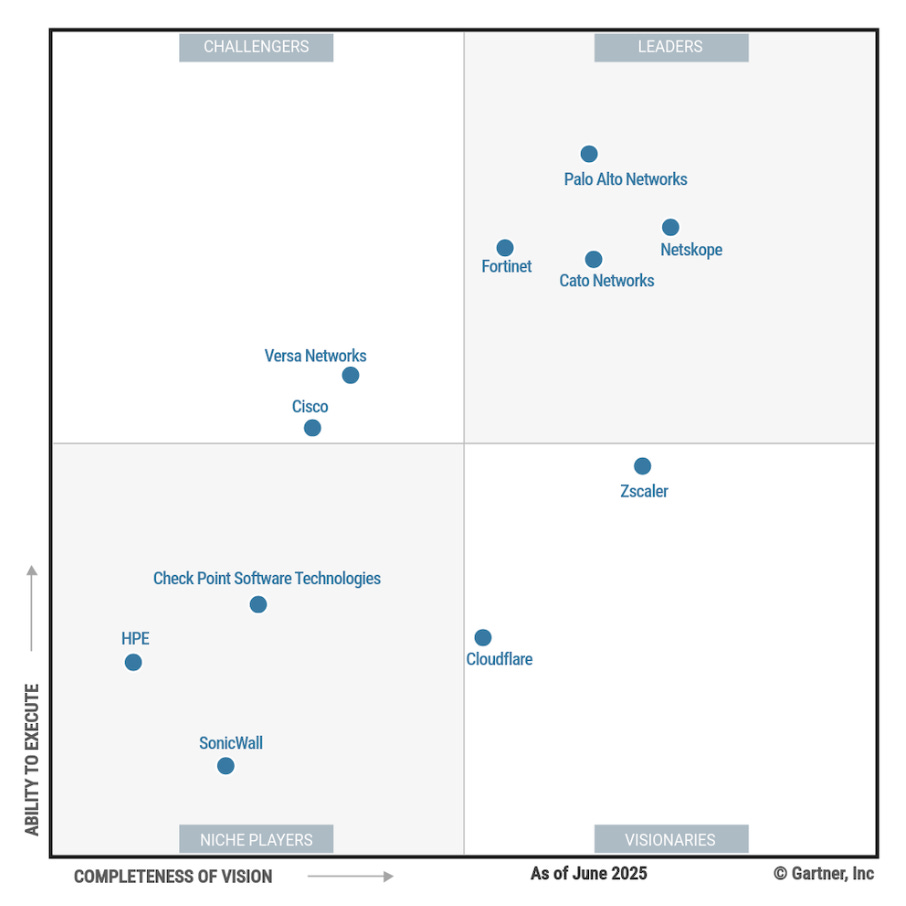

Netskope’s unified stack of tools that protects data, applications, and users is known in the security industry as a Secure Service Edge (SSE).

Over the last few years, Netskope has expanded beyond SSE into networking products that enable its customers to connect their employees securely to the internet without needing to use legacy VPNs or firewalls.

This combination of security + networking tools is known as a Secure Access Service Edge (SASE), and has become the defining product suite offered by network security leaders like Palo Alto Networks, Fortinet, and Zscaler - Netskope’s largest competitors.

Rather than list out Netskope’s 20+ products individually, I’ll focus on the ones that matter the most.

Cloud Access Security Broker (CASB): Netskope’s original core product. CASB provides visibility and control for data in cloud apps like Office 365, Salesforce, Slack, etc. It can detect sensitive data going into or out of cloud apps, and enforce policies (like preventing confidential files from being shared publicly), and protect against cloud-based threats. Netskope was one of the pioneers of CASB as a category.

Secure Web Gateway (SWG): A cloud-based web proxy that inspects and filters internet traffic. It protects users as they browse websites or use cloud services, blocking malicious content and enforcing acceptable use policies.

Zero Trust Network Access (ZTNA): Also known as Netskope Private Access, this allows authorized users to securely connect to internal applications without using a legacy VPN.

Next-Gen Firewall (FWaaS) and SD-WAN: These are the networking parts of Netskope One. They enable enterprises to route employee internet traffic through Netskope’s cloud and apply firewall policies without on-site hardware.

Netskope calls its private secure cloud infrastructure the Netskope NewEdge Network. With over 120 data centers in 75 regions globally, this is a competitive offering against companies like Cloudflare. By having global infrastructure, Netskope can offer its customers a fast internet experience with better security than legacy VPN providers.

Data Loss Prevention (DLP): Across the entire above suite of products, Netskope’s DLP features can detect and block sensitive data exfiltration (credit card numbers, intellectual property) and scan downloads for malware.

In summary, Netskope’s product has evolved from data security into a comprehensive platform of security and networking products that address a wide range of customer needs. From enabling safe SaaS usage, to completely replacing legacy firewalls, Netskope has consolidated a variety of use cases that position it to compete head-on against the biggest names in cybersecurity.

Business Model

Netskope has a classic subscription-based software-as-a-service business model. Most of Netskope’s revenue is from recurring subscriptions, structured as annual or multi-year contracts (typically 1-3 years).

The two primary levers that determine Netskope’s pricing are 1) the size of the customer’s employee base, and 2) the number of product modules they’re consuming.

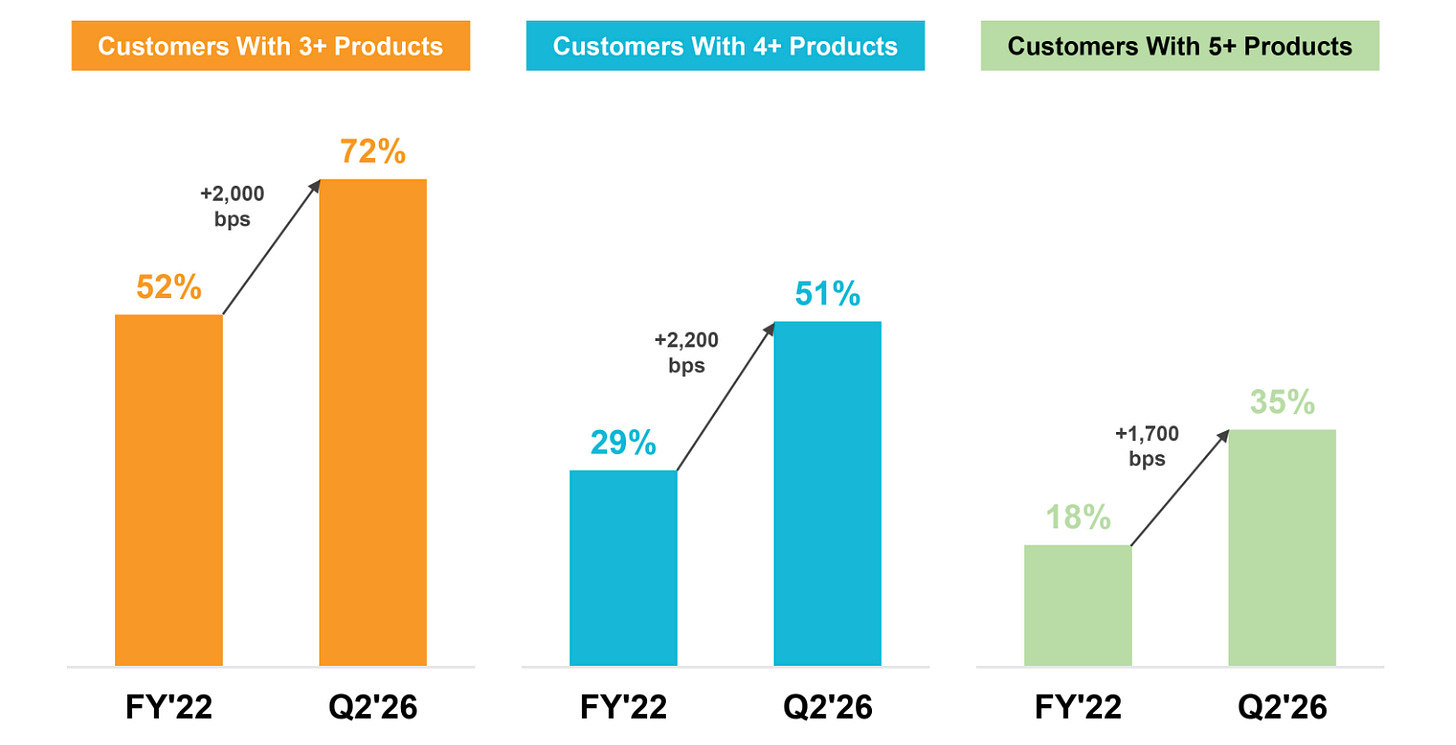

Netskope has been effective in selling into its installed base of customers, as the above chart shows.

In the last fiscal year ending Jan-25, 68% of the Netskope’s revenue growth was driven by expanding contracts with its existing customer base, and the other 32% of growth was driven by new customers.

Go-to-Market

Netskope’s GTM motion is focused on top-down, enterprise sales. Over 85% of its revenue comes from customers who spend over $100k per year. Netskope counts of 30% of the Fortune 100 and 18% of the Forbes Global 2000 as customers.

Roughly 1/3 of Netskope’s employees are in sales or customer-facing roles, and they often sell to the Chief Information Security Officer or senior head of security.

Like many cybersecurity vendors, Netskope relies heavily on a channel partner ecosystem of value-added resellers and managed service providers. 93% of Netskope’s revenue goes through partners, and 7% is directly between Netskope and the end-customer.

In the S-1, Netskope disclosed that one of their channel partners accounted for 12% of their revenue in fiscal year 2025. My guess is that partner is likely Exclusive Networks, who Netskope cites in their case studies as a key partner.

Leveraging partners is a key part of many cybersecurity vendors sales strategies. Microsoft, Cisco, Palo Alto Networks, Fortinet, and the largest security vendors all extensively use channel partners.

Many large enterprises prefer to procure their technology through a partner, who can help implement it and ensure success. For Netskope, they get to leverage the partner’s integration services teams without needing to manage that expertise in-house. Of course, the partner gets a cut of that revenue, but they also often end up pulling Netskope into deals, so these are highly synergistic relationships.

Financials and SaaS Metrics

Netskope has solid metrics, coming public just as it is inflecting to profitability while maintaining relatively high growth rates.

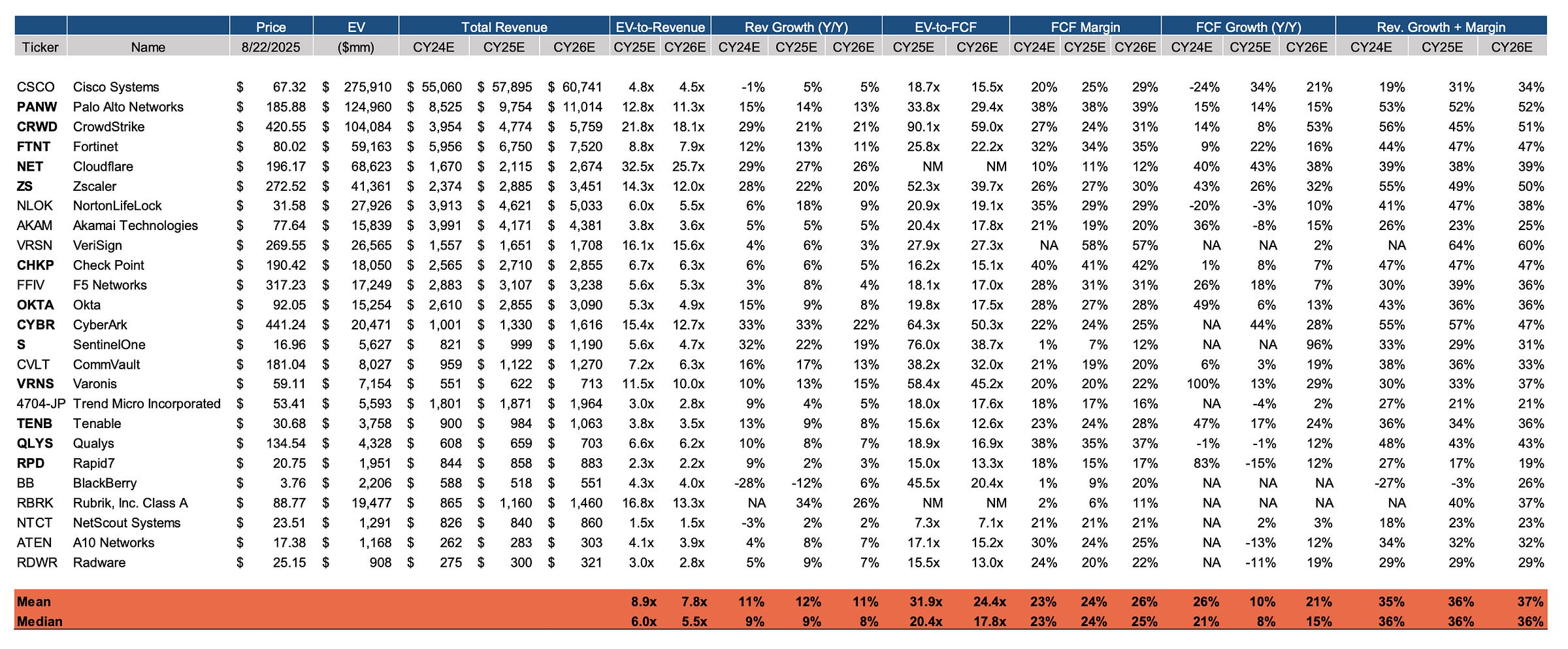

Below I compare Netskope’s key financial metrics to the 25 publicly-traded cyber security companies.

Note that Netskope is on a January fiscal year, so when I refer to fiscal year 2025, it is the 12-months leading up to January 2025, essentially equivalent to the calendar-year 2024. As of this writing in August 2025, Netskope is in its third quarter of fiscal year 2026.

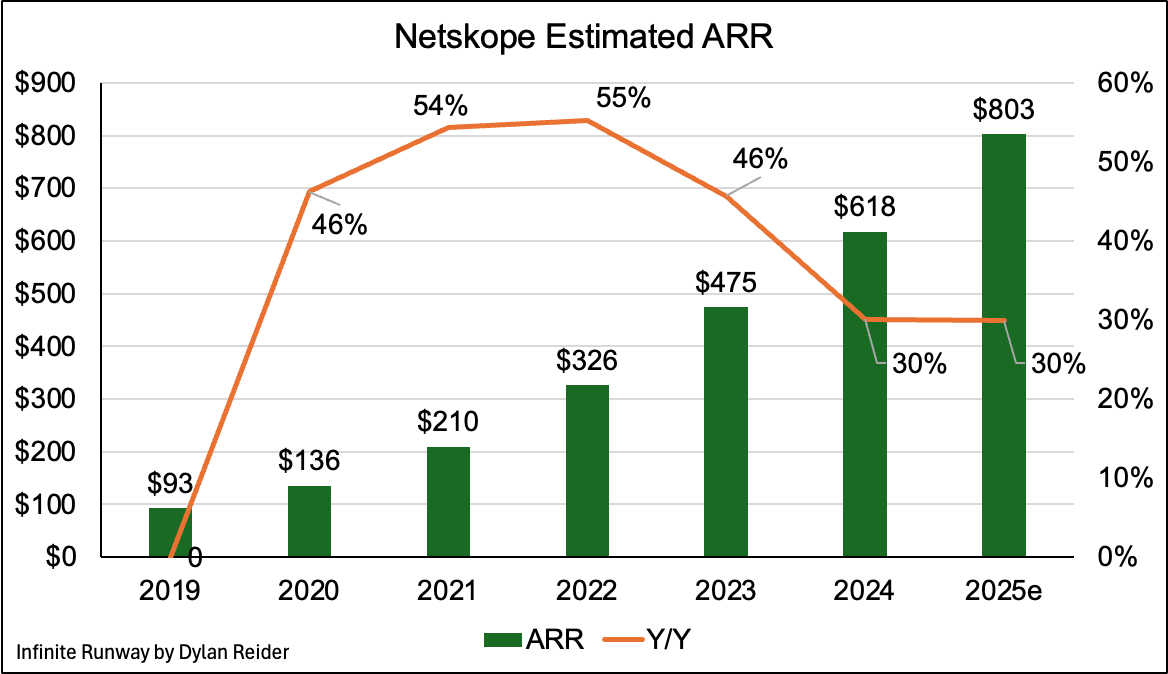

ARR: As of July 2025, Netskope reported $707M in ARR, up 33% from $531M in the July 2024 period. For fiscal year 2025 (calendar year 2024), Netskope reported $618M in ARR.

If we assume ARR growth continues at ~30% Y/Y, Netskope would achieve $803M.

Below I estimate Netskope’s ARR path over the last several years, based on a combination of data sources:

For data from 2019-2022, I use Sacra’s estimates.

For 2024 and 2023 I use data disclosed from Netskope in their S-1, for the fiscal years 2025 and 2024. Note the fiscal year is slightly misaligned from the calendar year, so these estimates are likely different from actuals.

For 2025 (fiscal 2026), I project forward 30% Y/Y ARR growth, conservatively based on ARR growth as of July-25, which Netskope discloses as 33%.

Revenue: In the most recent quarter, July-2025, Netskope reported $171M of revenue, up from $130M the year prior (+32% Y/Y). Annualized from the most recent quarter, this would be $684M. Last year Netskope delivered $538M in full-year revenue.

Assuming Netskope ends up delivering roughly $700M in full-year revenue for the 2026 fiscal year (2025 calendar year), it would be in the bottom half of publicly-traded cybersecurity stocks.

Netskope would be among the fastest growers though, and join only two other companies growing over 30% - CyberArk and Rubrik. However, with CyberArk potentially being acquired by Palo Alto Networks, Netskope stands to be the fastest growing cybersecurity company in the public markets (assuming the deal goes through and CyberArk is acquired).

Gross margins: Netskope’s gross margins were 69% in fiscal year-2025, and 74% in the first half of the current fiscal year 2026.

Netskope’s gross margins are slightly below the high-70s average for publicly-traded cybersecurity companies. The main reason for this is likely because of the infrastructure investments in building out its networking and datacenter network. As it grows its customer base on these products, it will realize operational efficiencies that bring it closer to Cloudflare’s gross margins in the high 70s and Zscaler in the low 80s.

Operating margins: Netskope’s operating margins are deeply negative, with -34% non-GAAP operating margins in fiscal 2025 and -19% in the first half of the current fiscal year 2026.

Most publicly-traded cybersecurity companies are larger, more mature and more profitable businesses than Netskope. Average margins for the group are in the low-20% range, but growth is lower. As Netskope continues to scale it should realize considerable operating margin leverage.

Free cashflow margin: Netskope’s free cashflow margins are also negative, with -28% non-GAAP operating margins in fiscal 2025, and -1% in the first half of the current fiscal year 2026.

Similar to operating margins, Netskope’s FCF margin from 2024 puts it at the bottom of publicly traded cybersecurity companies.

Rule of 40: Netskope’s Rule of 40 score is 31 in the most recent quarter (-1% FCF margins + 32% rev growth).

This puts it slightly below the median for cybersecurity stocks, which is 36 on the Rule of 40 score.

Additional key metrics:

Customers. As of July-25, Netskope had 4,317 customers, up 21% Y/Y from 3,571 one year ago.

Net dollar retention. 118% as of July-25, up from 113% one year ago.

Gross dollar retention. 96% as of July-25, compared to 95% one year ago.

Note - Netskope does not include contraction in its gross dollar calculation. It does include churned accounts, but excluding contraction is unusual compared to what is considered ‘standard’.

International presence: 46% of Netskope’s revenue comes from the US, while the remaining 54% comes from outside the US.

Market Opportunity and TAM

Netskope breaks down its TAM into distinct categories given the multiple markets that its SASE suite addresses. Netskope references IDC for the following market sizes.

Security. $24.4 billion in 2024, projected to grow at a 15% CAGR to $43.2 billion in 2028.

Includes secure web gateway, Zero-Trust Network Access (ZTNA), information protection/DLP, and virtual client computing.

Networking. $40.7 billion in 2024, projected to grow at a 18% CAGR to $78.4 billion by 2028.

Includes firewall, SD-WAN infrastructure, cloud & data center interconnects, 5G/4G enterprise wireless WAN, delivery platform (PaaS & software), segmentation, and IaaS networking.

Analytics. $9.2 billion in 2024, projected to grow at a 17% CAGR to $17.1 billion by 2028.

Based on enterprise network observability, Tier-2 SOC analytics, and cloud-native XDR; Netskope addresses these with UEBA, Advanced Analytics, Netskope Cloud Exchange (NCE) integrations, and Digital Experience Management (DEM).

AI Security. Netskope doesn’t provide a 2024 estimate, but frames it as a $30.8B opportunity in 2028.

Includes AI app access control, real-time user guidance around using AI, and data protection for AI usage.

Valuation

If you’ve made it this far, thank you for following along, let’s get to the fun part - what Netskope may be worth in the public markets.

Initial assumptions and estimates. Netskope’s revenue was $538M in calendar 2024 / fiscal year 2025, up 32.5% Y/Y. If we assume 30% growth in fiscal 2026 relative to last year, it would imply revenue of $700M this year. So far as of July this year, Netskope has delivered $328M of revenue, which would be 47% of our $700M annual revenue estimate. Last year, Netskope’s first fiscal half-year generated a similar 47% of full-year revenue, so we can assume our $700M estimate for this year is likely reasonable.

Publicly traded software companies often trade on investors’ estimate for not this year’s revenue, but the following year. Let’s assume Netskope decelerates growth from 30% to 27% in calendar year 2026 / fiscal year 2027. Assuming 27% Y/Y growth next year on our $700M estimate for this year’s revenue would imply $889M in revenue for next year’s revenue.

Comping to public peers. According to our cybersecurity comp group above, provided by Wolfe Research, the median company trades at a 7x multiple on 2026 revenue. The median company is only expected to grow revenue in 2026 by 11%, however.

With my estimates for Netskope to grow meaningfully above the median security stock over the next two years, I expect it will trade at a premium to the group. Cloudflare’s multiple of 26x 2026 revenue is likely too high, but recent IPO Rubrik at 13x and other high growers like Zscaler at 12x suggest a low-teens multiple on 2026 revenue may be reasonable.

Estimating Netskope’s valuation. Given the above, I expect Netskope to debut its IPO between 10-14x 2026 (fiscal-year 2027) revenue estimates, which I believe analysts will likely peg around $890M, and would imply a valuation between $9-12B. Given the recent demand for IPOs that we’ve seen with companies like Figma, there could be upside to that range. However, given the intense competitive landscape for network security and Netskope still being early on its path to profitability, I don’t expect the company to trade at a massive premium like Cloudflare.

Please note multiples are a short-hand for valuation. This is not my opinion of Netskope’s fair value, but rather a reflection of where multiples currently trade for cybersecurity stocks, and my view of where Netskope is likely to trade in the short-term.

Conclusion

Netskope is one of the defining cybersecurity companies of the cloud era. It embarks on its journey as a public company as a scaled category leader with a full security and networking product suite that can compete against the largest players in its category - Palo Alto Networks, Zscaler, Fortinet, and Cloudflare.

From here, the company’s mandate from the public markets will be straightforward: keep growth above 20%, expand profitability, and prove AI is a tailwind. That is the opportunity, as well as the test, for the company and its new shareholders.

Disclaimer: This analysis is for informational purposes only and is not investment advice.