Figma's S-1 Breakdown

The creative suite for the AI era

Figma was founded in 2012 as one of the first collaborative design tools. It has become one of the most important software companies of the SaaS era, breaking through a crowded market with a beloved product that came to redefine the design software category.

Many people outside of the design world remember Figma for the $20B acquisition attempt that Adobe made in 2022 to buy the company. $20B was a huge price for Figma, which at the time was reported to have roughly $400M in annual revenue. It was a clear admission by Adobe, the incumbent in creative software, that Figma had established a leadership position in collaborative design software. After regulatory hurdles led to the eventual breakup of the deal, Adobe was forced to pay a $1B break-up fee to Figma, which would continue on as an independent company.

In my opinion, Figma staying independent was a great outcome for the software industry, as Figma is a truly innovative business led by an incredible founder and CEO, Dylan Field, who now has the opportunity to take Figma to the next level by building a full suite of AI-powered software tools that address a variety of creativity and productivity related use cases beyond design.

On July 1, Figma filed their S-1, a legal statement that a company makes to the US Securities and Exchange Commission before they intend to list their stock on an exchange and sell shares to the public. S-1’s are jam-packed with tons of information about a company’s business. We are going to cover Figma’s founding story, product portfolio, go-to-market strategy, metrics, and more - plus where I think Figma will likely trade when it goes public.

Let’s dive in.

Founding Story

Figma was founded by Dylan Field and Evan Wallace in 2012. The two met at Brown University, and their initial vision was to move design to the browser, making design inherently collaborative and accessible to anyone involved in building software.

Design tools are software systems used by designers, product managers, illustrators, marketers, and front-end software developers. They can be used to design websites and applications, create specs for how a user experience should look and feel, or create visual assets that can be used in marketing and advertising campaigns.

Historically, design tools like Adobe and Sketch were downloaded to a user’s computer and used as a desktop application. That created inherent siloes, where users would work alone on a file and hand it off to their teammates when they wanted their input.

The technological breakthrough for Figma was WebGL, a technology that enabled graphics to be rendered in a web browser by tapping into a computer’s GPU. By using WebGL, Figma offered users a desktop-like visual design experience in the browser. As a browser-based application, Figma was able to provide its users with the breakthrough of multiplayer functionality. Think of it like Google docs, for design.

The dramatic improvement in user experience led to rapid adoption after Figma’s initial product launch in 2015. By focusing on collaboration, accessibility, and a rich plugin ecosystem of over 10,000 community-built extensions, Figma has cultivated a vibrant user community, and positioned itself as a platform for all things design.

Product

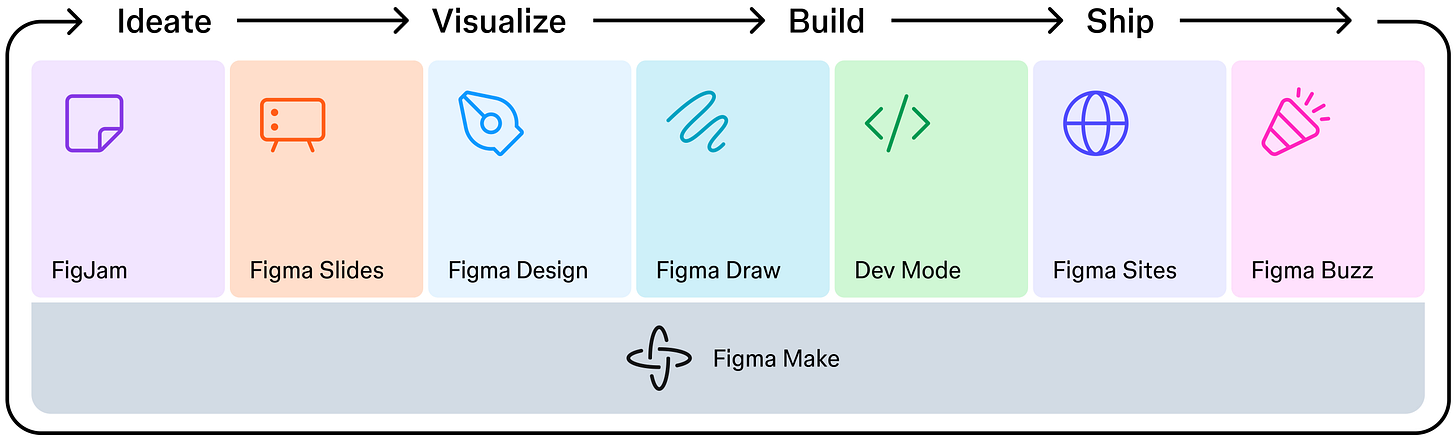

Figma has grown from its initial Figma Design tool into a multi-product suite of creative tools.

FigJam: A collaborative online whiteboard introduced in 2021 for brainstorming, ideation, and workshops. It has sticky notes, diagrams, and real-time ideation with playful, easy-to-use features. FigJam broadened Figma’s user base by engaging product managers, engineers, and others involved with early-stage collaboration.

Figma Slides: A newer offering launched in 2024 that enables creation of slide decks with Figma’s signature multiplayer approach. It targets use cases in which teams can design presentation decks together, bridging the gap between design and traditional presentation tools.

Figma Sites (CMS): Launched in 2025, Sites is a web content tool aimed at allowing teams to design and publish marketing webpages. Figma Sites lets users create on-brand marketing collateral and microsites easily, and expands the company into the no-code website design space, competing with tools like Webflow.

Dev Mode: In 2023, Figma launched Dev Mode, providing engineers with a tailored view of design files, and makes hand-off from design to code more seamless by integrating developer needs directly into Figma.

Figma Buzz: Figma Buzz is a tool for creating and sharing content such as social media assets, display ads, and more. Its targeted at marketing teams, directly positioning against template-driven design tools like Canva.

Figma Make: Part of its AI-centric product push, Figma Make uses AI to allow users to write a prompt and generate a workable prototype, and potentially even a production-ready output.

Figma Draw: Figma Draw is a dedicated product for detailed editing and product illustration.

Underscoring my point about Figma’s ability to innovate faster as an independent company rather than as a subsidiary of Adobe, Figma released four of the above products just this year. Figma Make, Draw, Buzz, and Sites were all released in 2025.

The arc of Figma’s product expansion over the last decade reflects its growing user base, starting with designers and expanding to marketers, developers, illustrators, and more.

Business Model

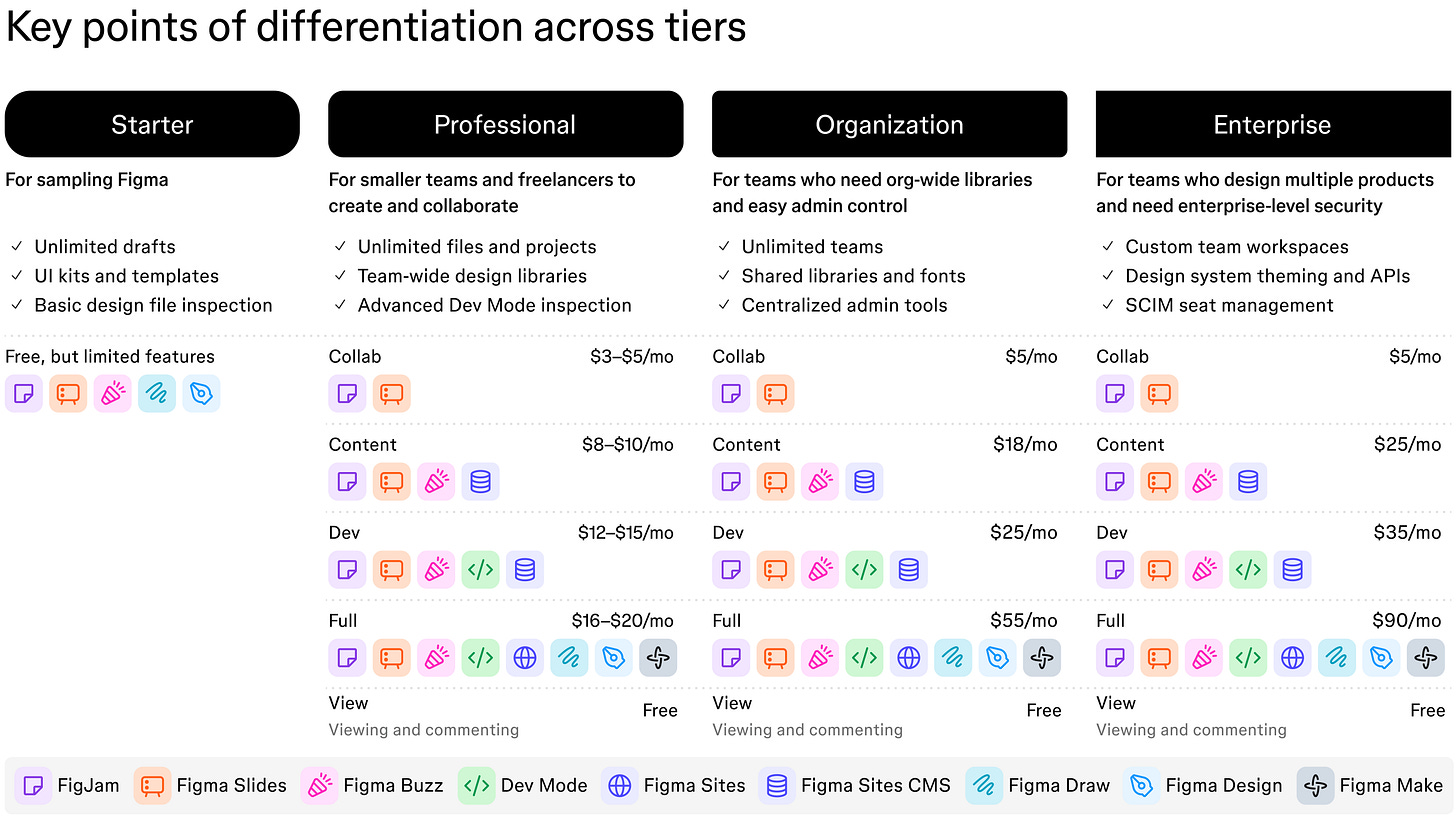

Figma has a classic freemium SaaS business model that leverages a product-led growth strategy. Figma offers packages sold as annual or monthly subscriptions, and prices its product on a per user (or per seat) basis. These recurring subscription fees are the primary source of Figma’s revenue.

Starting in March 2025, Figma made the interesting decision to change its product packaging. Rather than offer individual licenses on a per product basis, it offers different types of multi-product licenses (seats) that customers can pick from depending on their needs. Each of the below seat packages includes access to FigJam and Figma Slides.

The Viewer seat allows users to view files and leave comments for free.

The Collab seat gives access to FigJam and Figma Slides.

The Content seat gives access to Figma Buzz, Figma Sites CMS, FigJam, and Figma Slides.

The Dev seat gives access to Dev Mode, in addition to Figma Buzz, Figma Sites CMS, FigJam, and Figma Slides.

The Full seat gives access to all of Figma Design, Figma Draw, Figma Make, Dev Mode, Figma Buzz, Figma Sites, FigJam, and Figma Slides.

Go-to-Market

Figma’s GTM strategy is reliant on an initial product-led sale, and is complemented by targeted enterprise sales for large accounts.

Users can start for free and become paying users as they want access to more features. As Figma’s customers increase their paid users, entire teams may adopt the product, at which point Figma can leverage its enterprise sales teams to create a standardized license agreement across the customer’s business.

In summary: viral free usage → team adoption → enterprise standardization. This is often referred to as a “land and expand” strategy in the software industry.

As Figma adds new products, including the four new products it released this year, it can increase monetization either by bundling them into higher-tier plans or potentially introducing new pricing/packaging (as it did in March, discussed above).

To support its bottom-up sales strategy, Figma has invested heavily in building a large, global user community. Config, Figma’s annual user conference, attracts thousands of attendees (8,500 this year), and Figma has local user meetups around the world. Figma’s community resources are often driven by users themselves, and they have created over 250,000 resources and more than 10,000 plugins that allow users to customize Figma for their workflows. Figma’s own content marketing efforts complement these grassroots initiatives, to help onboard and inspire new users.

Financials and SaaS Metrics

Figma has strong metrics, with a scaled revenue base that continues to grow efficiently. Below I compare some of Figma’s key financial metrics to a roughly 120 company universe of publicly-traded SaaS stocks.

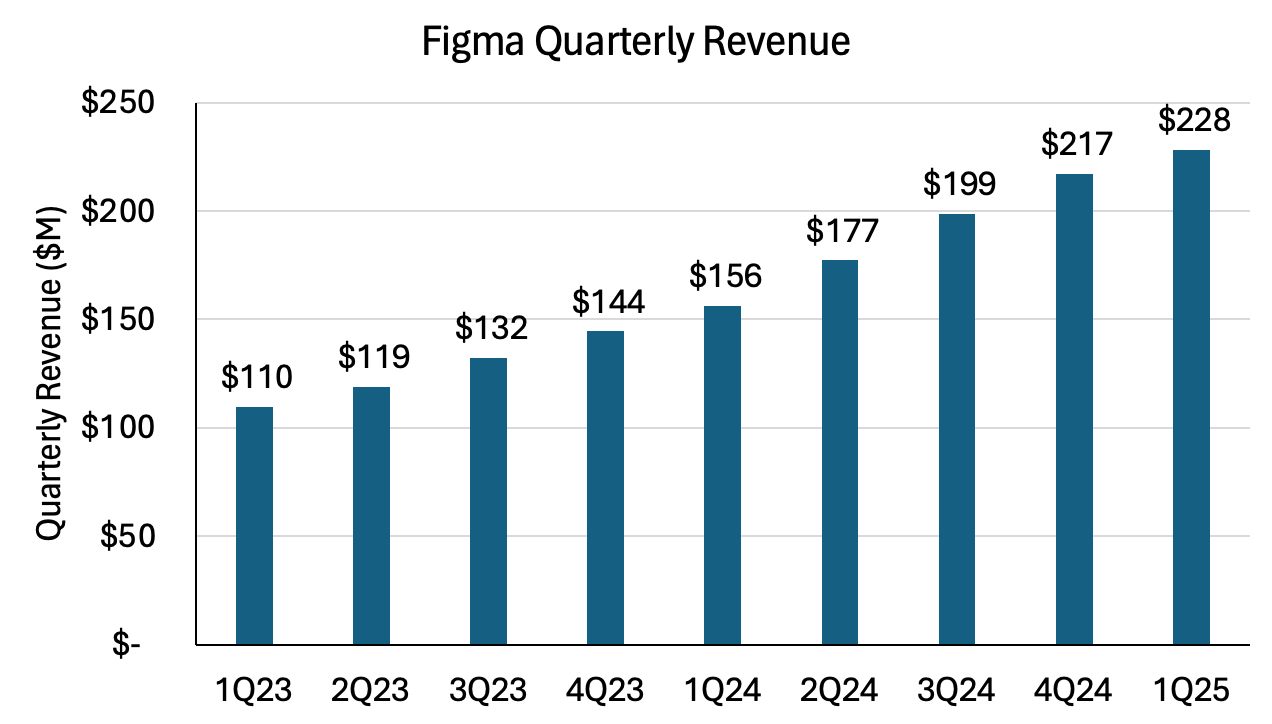

Revenue: In the most recent quarter, March-2025, Figma reported $228M of revenue, up from $156M the year prior (+46% Y/Y). Annualized, this would be $912M. For the full year 2024, Figma reported $749M, up 48% Y/Y.

Figma would be the fastest growing company in the publicly-traded software universe, and the only company with above 40% revenue growth. In terms of size of revenue base, at $749M in 2024 this puts Figma in the bottom half of publicly-traded SaaS companies, with roughly 80 companies that revenue above Figma’s $749M.

Gross margins: Figma has best-in-class gross margins of 92% on a non-GAAP basis, and 88% on a GAAP basis, for the full year 2024.

Figma’s 92% non-GAAP gross margins would make it #4 on the SaaS charts, behind Doximity, Autodesk, Ansys, and GitLab.

Operating margins: Figma’s operating margins are also strong, with 17% non-GAAP operating margins in 2024. GAAP operating margins were -117% in 2024, primarily due to stock-based compensation.

With 17% operating margins in 2024, is right around the middle of the pack of publicly-traded software companies, with about 50 companies below it.

Free cashflow margin: Figma’s reported adjusted free cashflow margin was 24% in 2024, up from 18% in 2023. In the March-2025 quarter, Figma reported 41% free cashflow margins.

Similar to operating margins, Figma’s adjusted FCF margin from 2024 puts it in the middle of publicly traded SaaS companies. However, if it can maintain the 40% range delivered in 1Q25, this would put Figma in the top 5 SaaS companies by FCF margin, with the top 4 being Doximity, Applovin, Palantir, and Paychex.

Rule of 40: Figma’s Rule of 40 score is 87 in the most recent quarter (41% FCF margins + 46% rev growth), and 72 in 2024 (24% FCF margins + 48% rev growth).

This puts it among the top Rule of 40 companies including Applovin, CyberArk, Monday.com, Snowflake, and Zscaler, which are 74 and above.

Users. Figma has 13M monthly active users as of March-2025, two-thirds of which Figma claims are non-designers.

Customers. Figma has 450,000 paid customers as of March-2025, including 10,517 customers paying it over $10k per year, and 963 customers paying Figma over $100k per year. Over 40 customers pay Figma over $1M per year.

The $10k+ ACV cohort below accounted for 64% of Figma’s revenue in the March-2025 quarter, while the $100k+ ACV cohort accounted for 37% of revenue.

95% of the Forbes 500 use Figma, and 78% of the Forbes 2000 use Figma.

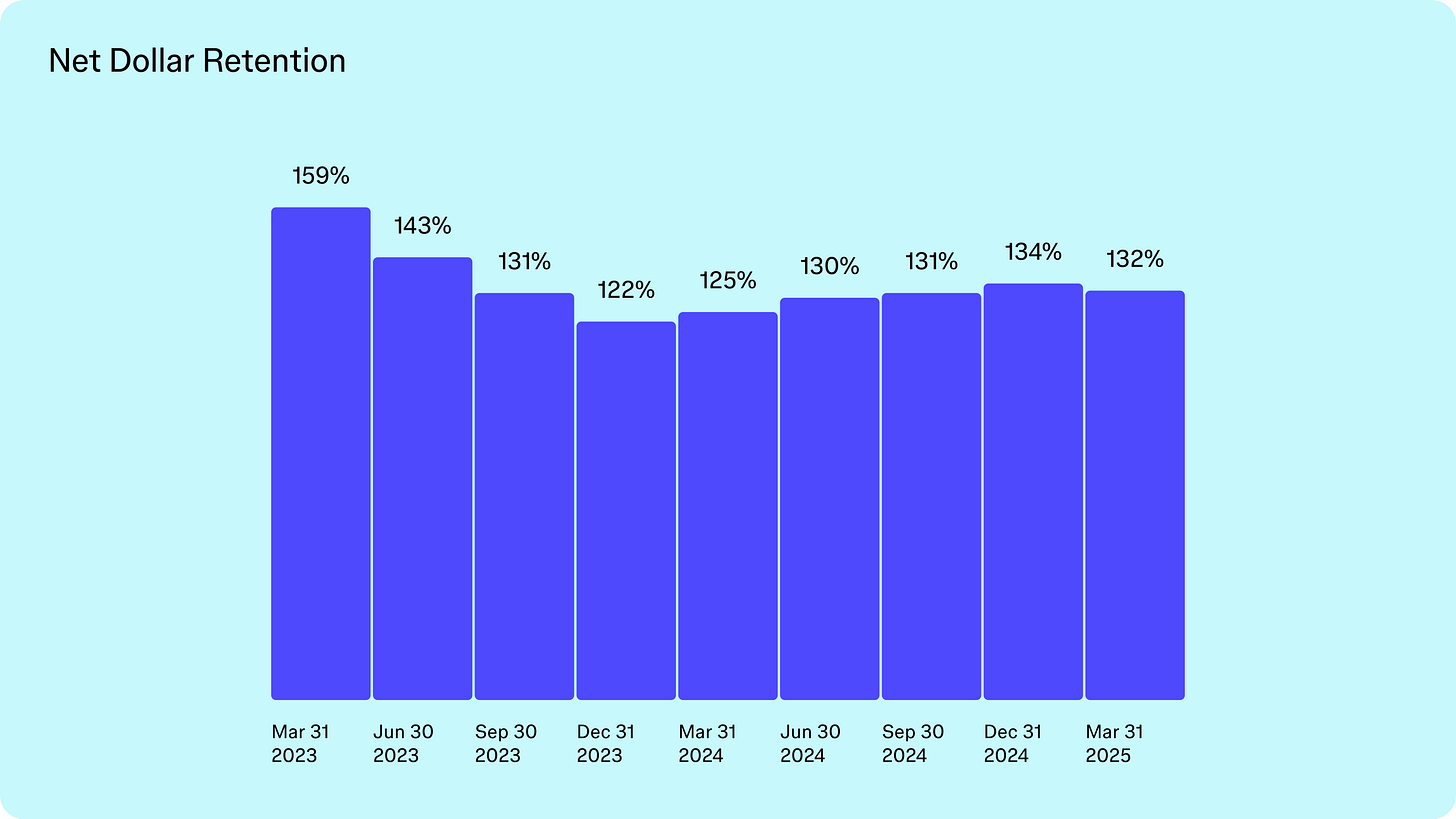

Net dollar retention. Figma’s net dollar retention is 134%, which would be considered best-in-class among public SaaS companies.

However, Figma calculates its net dollar retention by taking the $10K ACV cohort of customers, calculating their revenue today, and comparing it to that group of customers’ revenue one year ago.

This is the opposite of the standard NDR definition, which would take a given year’s cohort of customer revenue, and compare the following year’s revenue from that same customer cohort (including both up-sell and churn).

This makes Figma’s net dollar retention metric more akin to a “gross bookings expansion” metric, as it does not include churn.

Gross retention rate. Figma reports a 96% gross retention rate, which similar to the NDR discussion above is very impressive but requires some caveats.

Figma calculates gross retention similarly to its net dollar retention metric, by taking a given period’s revenue from customers with over $10k ACV, comparing that cohort’s revenue to the year prior after subtracting churned customers.

If Figma were to include its entire customer base, and look at down-sells as well, it would yield a meaningfully lower gross retention rate.

International presence. 85% of Figma’s monthly active user base came from outside of the US in the March-2025 quarter, while 53% of revenue came from outside the US.

In the below charts I highlight some of the most interesting charts from the S-1 as it relates to metrics discussed above.

Market Opportunity and TAM

In its S-1, Figma positions itself at the center of a generational shift toward digital product design and collaboration.

Figma cites IDC data, claiming a $33B total addressable market encompassing the “global workforce engaged in digital product design”. This probably includes all spending on design and collaboration tools, across all user groups from designers to marketers to developers. Figma calls out that it sponsored the IDC study it references in calculating its TAM, titled “Global Workforce Engaged in Software Design Expands to 144 Million by 2029”.

It’s always difficult in calculating an exact TAM for global software companies like Figma. What I often consider more important than absolute TAM size is what are the tailwinds or headwinds effecting the market’s growth. In the case of Figma it has a number of key market opportunities in its favor:

Digital Transformation: Every industry is building digital products (websites, mobile apps, internal tools), driving demand for design tooling.

Collaboration/Remote Work: Global and remote teams require cloud-based, real-time collaboration platforms.

Legacy Displacement: Figma’s modern collaborative design approach is displacing legacy incumbents like Adobe and Sketch.

Cross-selling: Figma’s expansion into whiteboarding, presentations, and web development, among other categories, place it into very large software markets in the productivity category.

Up-selling: Figma has a massive expansion opportunity within its existing customer base. 78% of Forbes Global 2000 companies have Figma users, but only 24% of them spend >$100k with Figma. 76% of customers use 2+ products, and with Figma releasing 4 new products this year alone, there will be ample opportunity to deepen existing customer relationships.

Valuation

If you’ve made it this far, this might be the part you are most interested in, so let’s dive into Figma’s valuation.

Initial assumptions and estimates. Figma’s revenue was $749M in 2024, up 48% Y/Y. If we assume 40% growth in 2025 relative to 2024, that would place Figma’s 2025 revenue at $1.05B. It has already achieved $228M in 1Q25 revenue (+46% Y/Y), which would be 22% of our $1.05B full year revenue estimate, which compares similarly to the 21% that 1Q24 represented for the full year 2024. So our $1.05B revenue estimate for 2025 seems reasonable.

Publicly traded SaaS companies often trade on investors’ estimate for not this year’s revenue, but the following year. Let’s assume Figma can again achieve 40% revenue growth in 2026, which would be $1.47B up from our $1.05B estimate. Assuming it grows 40% in 2026 may be aggressive, but our 2025 40% growth estimate may prove to be conservative. So even if the numbers differ slightly from year to year, the ~$1.5B revenue estimate for 2026 may be reasonable.

Comping to public peers. According to Wolfe Research, there are 13 publicly traded SaaS companies expected to grow over 20% in 2025. This cohort includes Palantir, CyberArk, Monday.com, Klaviyo, Cloudflare, Snowflake, Samsara, GitLab, SentinelOne, Zscaler, Crowdstrike, DataDog, and OneStream. This group trades at a 16.5x average revenue multiple on 2026 revenue estimates, and an 11.6x median multiple. Palantir, which trades at 66x 2026 revenue estimates, dramatically pulls up the average for the group. The second highest 2026 revenue multiple for the group is Cloudflare, at 25x.

With Figma’s revenue growth last year of 48% and 1Q25 revenue growth of 46%, it easily clears the fastest growing public SaaS company, Palantir, which is expected to grow 36% this year. That said, Palantir’s 66x 2026 revenue multiple is in meme stock territory, and I don’t expect Figma to price there. That said, I do expect Figma to get a meaningful premium to the 11.6x median. Figma has meaningful better growth, gross margins, and rule of 40 scores than Cloudflare and Crowstrike, which at 25x and 21x 2026 revenue estimates are the #2 and #3 highest revenue multiple SaaS stocks (per Wolfe Research).

Estimating Figma’s valuation. Given the above, I expect Figma to debut its IPO between 12-18x 2026 revenue estimates, which I believe analysts will likely peg around $1.5B, and would imply a valuation between $22-27B. I expect in the days/weeks after the IPO it’ll likely trade up to 20-25x 2026 revenue estimates, which would give it a $30-37.5B valuation range.

Please note these are quite frothy multiples, indicative of the current stock market environment that is bidding up tech stocks relentlessly. This is not my opinion of Figma’s fair value, but rather a reflection of where multiples currently trade for high quality software companies like Figma.

Conclusion

People often talk of category-defining companies. Figma is one of the truly category-defining software businesses of the SaaS era.

Now that we have entered a new software era of AI, Figma has an opportunity to redefine itself from a design software company to an AI-powered creative suite. It’s very exciting that the company is choosing to embark on that journey in the public markets. Go Figma!

Disclaimer: This analysis is for informational purposes only and is not investment advice. Please do your own research.