10 Themes for 2026

Predictions on AI, software, and the economy

Yes, we’re 13 days into the new year and I’m writing a predictions blog. As Larry David would say, we’re past the statute of limitations on saying “happy new year”, but if you ask me 2 weeks is fair game for annual predictions blog posts, so let’s get into it.

2025 saw a deepening of AI usage as the technology’s users shifted from early adopters to mass market appeal. ChatGPT crossed 800 million weekly active users and will likely cross one billion soon. Google took the plunge and integrated AI answers into its search engine. Across the economy, workers in every field from doctors and lawyers, to HVAC technicians and logistics operators, and even your friendly neighborhood venture capitalist - are seeing their jobs augmented and even transformed by AI. And it’s just getting started.

What follows are ten themes and predictions I expect will define AI, software, and technology in 2026.

1. Chatbots Go Vertical

The first killer use case for AI is the chatbot. Yes, there are tons of software companies building applications on top of AI - coding assistants for developers, note-takers for sales reps, AI agents for customer support - many awesome companies building killer products, a few of which I’m lucky to call myself an investor in.

But by and large, the world-changing products have been ChatGPT and Claude. For most people, if you asked them how they use AI in their daily life, it’s those two products. They are general-purpose tools that do everything from writing code to planning a vacation.

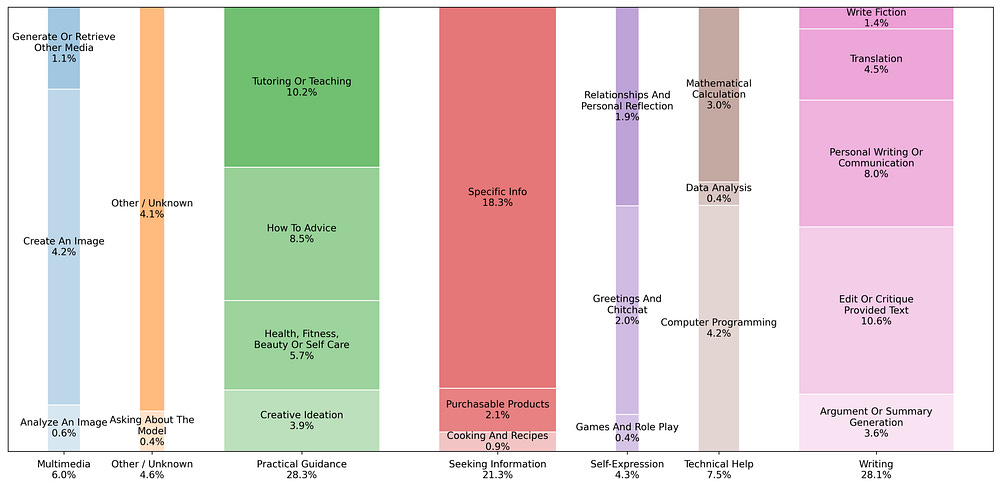

A paper from OpenAI published the image below in September that breaks down how people use ChatGPT.

Of course, the AI labs have this data broken down far more deeply than the above chart. They know exactly what drives the most engagement and retention, and can hypothesize what will create the most willingness to pay.

In 2026, expect them to act on it.

The AI labs will start shipping specialized product interfaces for the highest value use cases inside of the apps we already use - ChatGPT, Claude, Gemini, Grok, etc. - rather than be standalone apps the way OpenAI released Sora.

The AI labs will do this not because the models can’t answer these use-case-focused questions today, but because their value will go beyond a generic chat interface. Persistent context, data connectivity, compliance & controls, and structured workflows will combine to deepen the value the chatbots provide their users.

Coding came first, with Anthropic’s Claude Code and OpenAI’s Codex, but these were just the beginning.

OpenAI’s announcement of ChatGPT Health last week is a perfect example of this. ChatGPT Health creates a dedicated space within ChatGPT that allows users to connect medical records and data from wearable devices, and create a dedicated thread of conversations with compliant data controls. ChatGPT Health will remember specific health-related things about the user, so that it builds up context the way a doctor would.

I expect we are going to see similar moves by Anthropic within health. I predict both OpenAI and Anthropic will expand their chatbots’ offerings to have specialized features in finance, education, travel, and shopping.

These are already some of the top use cases in AI assistants, but more importantly they are some of the largest areas of consumer spending in the US economy today - amounting to tens of trillions of dollars annually. Today, the AI labs monetize through subscriptions and API calls. But if AI assistants become how we manage our health, plan our finances, book travel, and shop? The TAM goes far beyond productivity software and search advertising.

Not all of these use cases will be flawless by year-end. Take shopping for example, The Information recently published an article on why agentic e-commerce has taken longer to go mainstream than some would expect.

But by year-end it will be clear that AI’s first killer use case - the chat interface with a blinking cursor - was just the beginning of how the world’s billions of internet users will come to see AI.

2. AI Drives Corporate Margin Expansion Across Economy

AI is the corporate equivalent of a GLP-1, as it helps companies lose weight (cut costs) and reduce cravings (eliminate redundant hiring), while retaining muscle (growing revenue).

The net result? Margin expansion.

Take C.H. Robinson. Founded in 1905, C.H. Robinson is a boring, old logistics business that acts as a middleman in shipping, helping get goods from point A to point B across air, water, and land. And in 2025, they have seen revenue decline by 9% Y/Y due to a combination of a weak freight environment and divestitures. Yet their operating profits are up 26%, and the company saw operating margins expand to 30%, up from 24% a year ago. C.H. Robinson attributes this in part to the deployment of over 30 proprietary agentic AI tools, which improved quote response rates from 65% to 100%, cut response times from 17 minutes to 32 seconds, and allowed the company to handle more volume without adding headcount.

So how did the market reward C.H. Robinson’s stock in 2025? Not with a golf clap, but rather with thunderous applause. CHRW ripped up 59%, outperforming the darling of the AI era - Nvidia’s return of 39%.

C.H. Robinson’s ability to use AI as an operational lever has transformed its business and allowed it to prevail through a tough macro cycle that would typically see profits decline.

And it’s a preview of what’s coming across the economy.

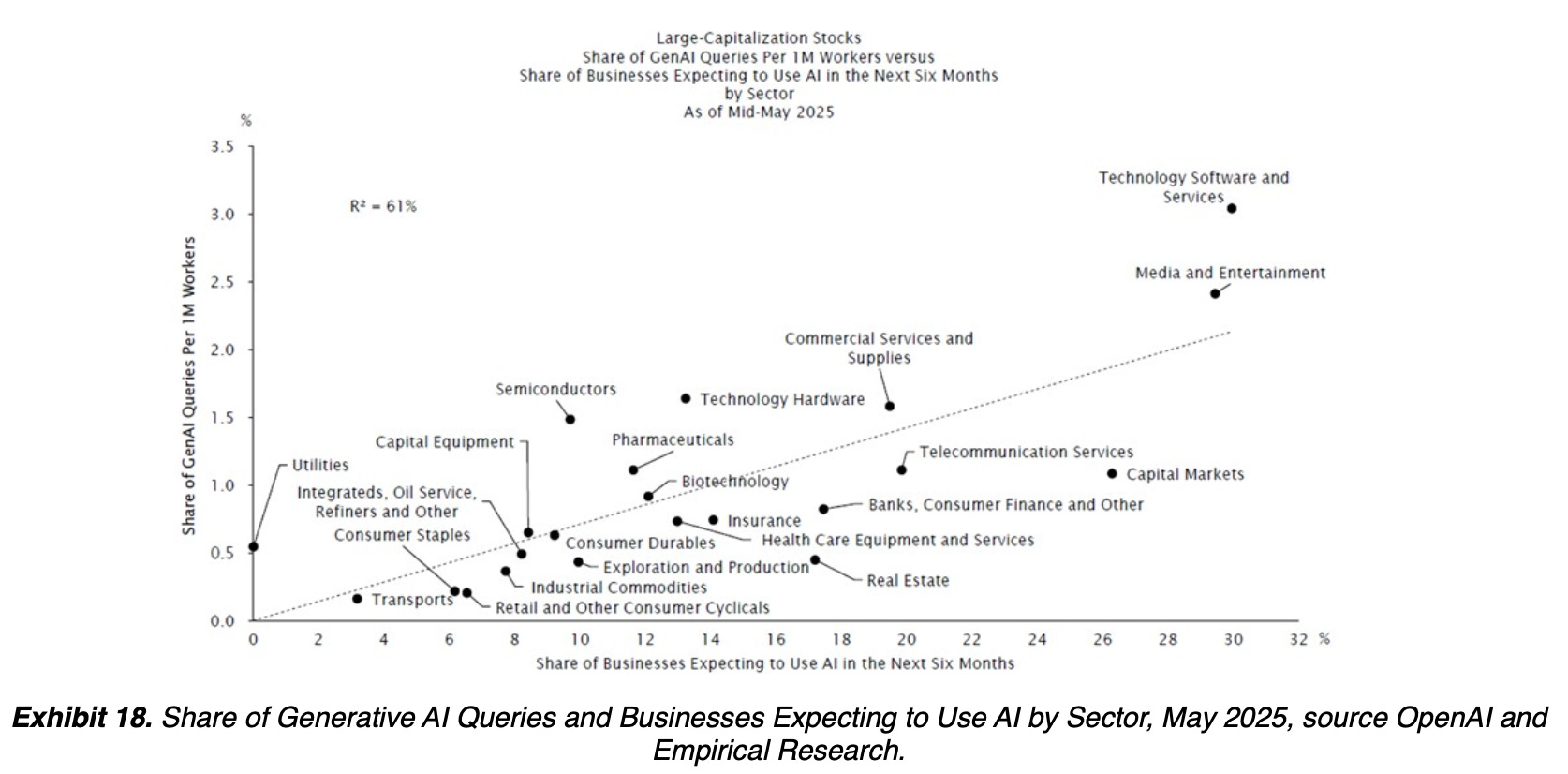

In the above chart, the X-Axis shows AI penetration - the share of businesses in a given industry expected to use AI in the next 6 months. The Y-Axis shows AI usage intensity - the share of GenAI Queries per 1M workers. Tech-forward industries that operate using lots of data - tech, media, capital markets, telecom, banking, commercial services - are the furthest along in adopting AI in their business. The laggards include transportation, utilities, oil companies, and retailers.

My prediction: Some of the best performing AI stocks in 2026 are going to be non-tech companies. Banking, insurance, capital equipment, logistics, and other old-world industries will see companies leverage AI to compress the cost and time required to produce work.

It’s not just tech anymore. The AI margin opportunity is here and will be coming to every industry across the economy.

3. AI’s Hiring Impact Becomes Widely Felt

A corollary to my last prediction is that companies will need to hire fewer workers.

Even if AI doesn’t result in the mass layoffs that many AI doomers are predicting, the impact of companies needing to hire fewer people will be felt strongly across the economy in 2026.

It will show up in the news we consume, the job market statistics, the way in which young people plan their post-college job search, and how people vote at the polls in the midterms.

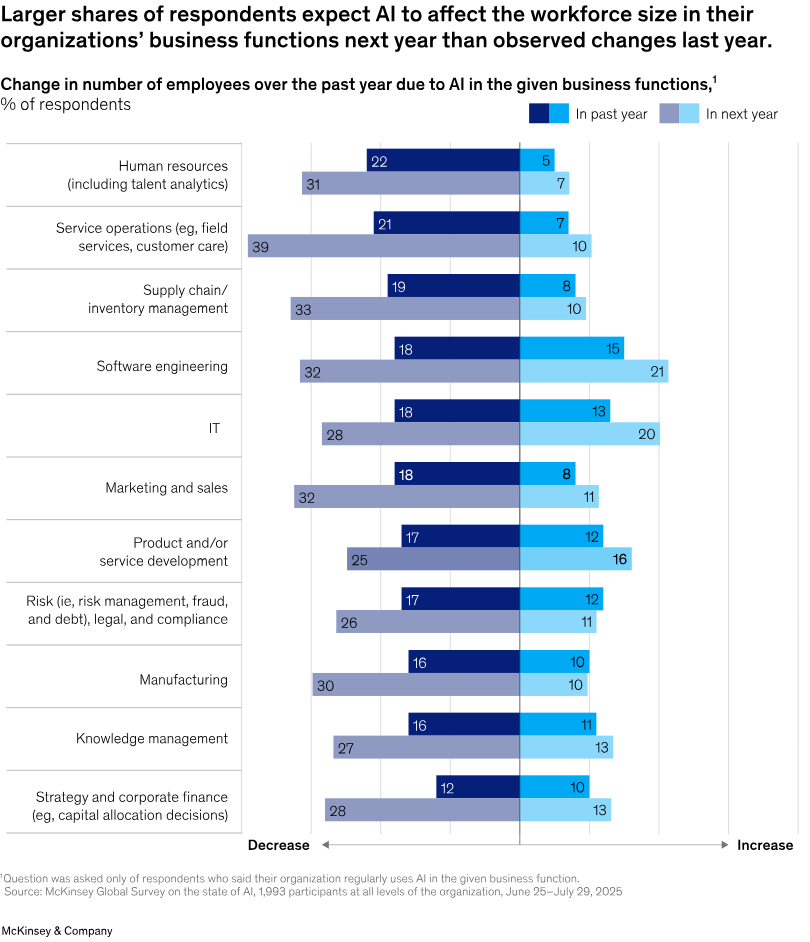

The impact of reduced hiring will be felt strongest in coordination-heavy roles that exist to move information and manage project hand-offs. Back-office operations like supply chain, risk, customer support, and HR ops are all functions that stand out as being relatively more affected due to AI according to a recent McKinsey study. And 2026 is expected to see meaningfully more impact than 2025.

This doesn’t necessarily mean layoffs, but it will mean fewer new hires. Companies just don’t need as many people to grow as they used to.

AI is exposing how much of the modern corporation was built to manage inefficiencies and friction, rather than grow and create value. Companies will be leaner going forward, but the economy will be more fit as a result.

And just as existing companies need fewer people to grow, new companies need fewer resources to start, leading to an increase in entrepreneurship and new company formation.

4. Consumer AI Products Launch Ads

It’s been a long time coming, but in 2026 we will see the original business model of the internet - advertising - become an important part of AI business models.

It’s clear that OpenAI is very likely to put ads in ChatGPT. They’ve already started testing this, resulting in some negative user feedback. In forecasts to investors, the first “free user monetization” revenue begins kicking in this year.

Google is already monetizing its AI summaries, and while it hasn’t put ads in Gemini, its ChatGPT competitor, just yet - I wouldn’t be surprised to see them this year.

It’s not just the big players - startups like OpenEvidence are having success monetizing their users through ads. OpenEvidence offers a ChatGPT-style AI interface for doctors that allows them to do research and ask medical questions. Nearly half of all physicians in the US use OpenEvidence, which is generating over $150M in annualized revenue via ads, and was recently valued at $12B.

The first banner ad was displayed in 1994, and while ads fortunately are less annoying than they used to be, the hyper-targeted nature of AI inquiries means they stand to be more valuable than ever.

The challenge of 2026 for the AI labs: monetize their free tier without degrading the product. Get it wrong, and their users will leave to an alternative AI chatbot. Get it right, and they’ve unlocked a massive new consumer AI business model.

5. ChatGPT Continues to Reshape Software Expectations

In Raising the Bar, I talked about how ChatGPT is resetting user expectations of software products. The same way Robinhood’s commission-free, mobile-friendly trading changed user expectations around the ease of buying and selling stocks, and the same way Amazon Prime changed the speed at which users expect their deliveries - ChatGPT is changing what users expect of their software.

Users now expect instant value without signup friction. They want software that anticipates their needs and acts on their behalf, whether it’s updating CRMs, booking travel, or sending follow-up emails. Users want to talk to their software, feed it screenshots and PDFs, and get structured outputs. And they want transparency: editable system prompts, explainable decisions, clear guardrails.

These features are becoming table stakes in every piece of software, and it is happening fast.

Many incumbent software providers will prove to be surprisingly slow in shipping products that create truly game-changing user experiences. For startups, the opportunity is clear to become the next generation of companies that raise the bar for the rest of their industry.

6. Software Stocks Further Divide Into Haves and Have-Nots

2025 was a tough year for publicly traded software stocks. The IGV, an index that tracks the software sector, was up 1% in 2025, while the S&P500 was up 17% and the NASDAQ up 21%.

Meanwhile, many application software companies saw their stocks get crushed, like:

Hubspot, -42%

Monday.com, -37%

Atlassian, -35%

ServiceNow, -28%

Adobe, -21%

Salesforce, -20%

Workday, -17%

And yet, many infrastructure and cybersecurity software stocks ripped:

MongoDB, +80%

Snowflake, +42%

Crowdstrike, +37%

Twilio, +31%

Zscaler, +25%

So what gives?

2025 was a year of bifurcation within software. A small group of stocks, primarily in infrastructure & cybersecurity software, drove most of the gains in the sector because they were viewed as clear AI beneficiaries.

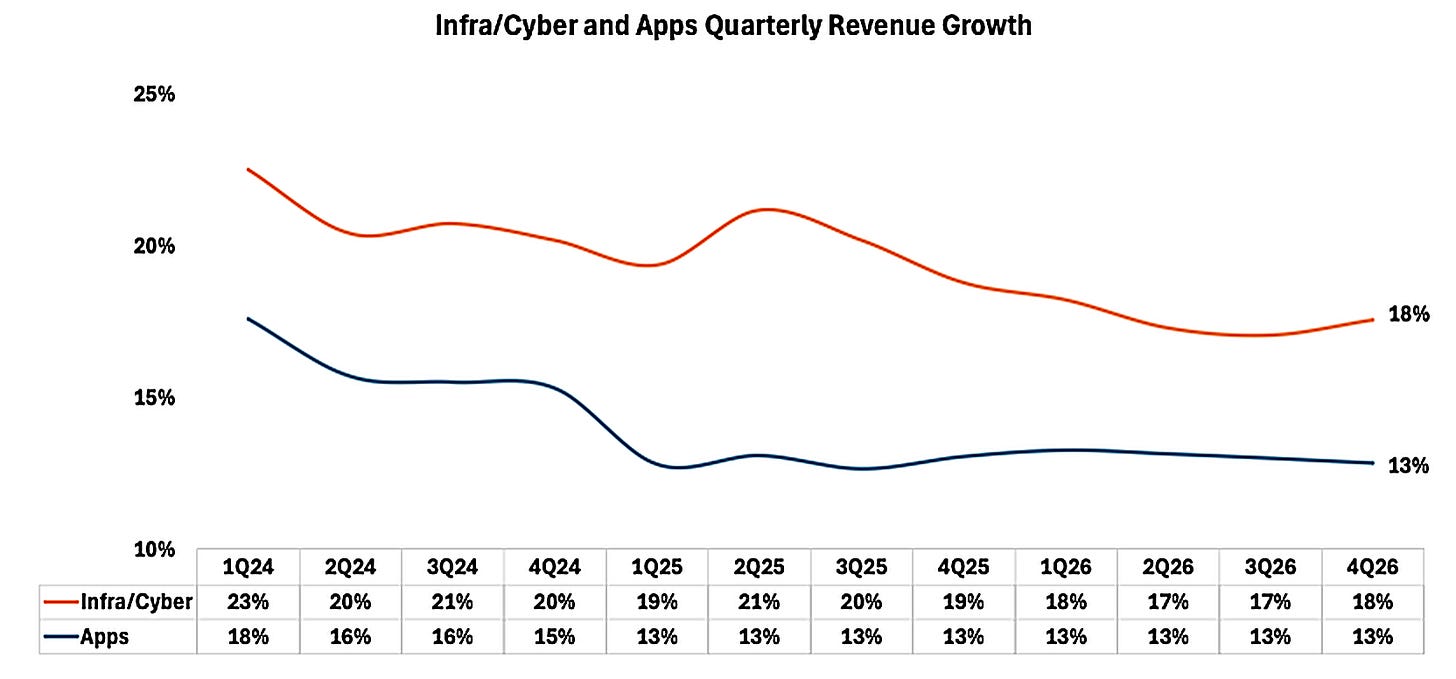

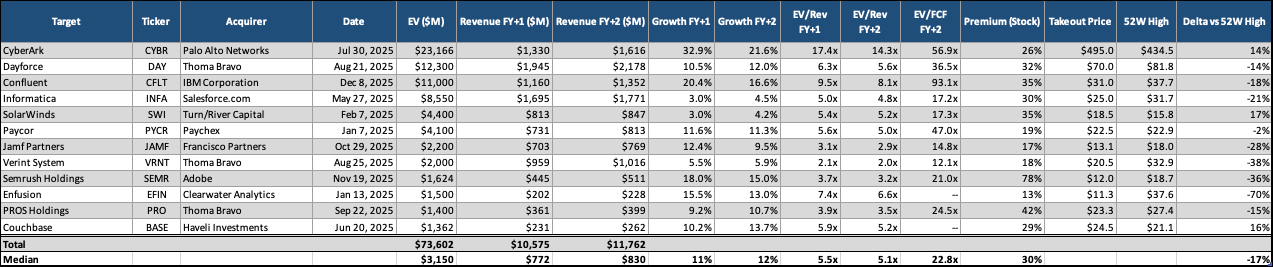

As the two charts above show, among publicly-traded software businesses, infra/cyber stocks have out-grown their application-layer counterparts. Even more importantly, the forward-year growth estimates for consumption software (i.e. infra) have been revised up vs. application software which have been revised down (although only slightly).

Put simply, software stocks that didn’t translate AI investment into financial metrics suffered - even if they had solid results. Investors held an apathetic view towards the software sector, diverting attention and dollars to AI “picks and shovels” ideas like semiconductors, networking gear, data centers, and energy.

In 2026, the bifurcation of the AI "haves” and “have-nots” will deepen within software.

However, I expect many of the large cap application platforms like Salesforce and ServiceNow that traded down in 2025 to see outperformance in their stock prices, driven by AI monetization.

Those best positioned have high gross customer retention, broad platforms with expansive budget presence, and a culture of shipping (or acquiring) new products. These companies stand to see new sources of revenue from AI-related features in 2026, as well as AI-driven margin expansion and cost efficiencies.

On the other hand, software companies that offer narrow point solutions, who sell to a user base whose jobs will likely get replaced or reduced by AI (i.e. customer support), and who lack the management team / execution capability to navigate through this type of product transition are poised to see another year of underperformance.

7. Prediction Markets Double Trading Volume

Earlier this year I wrote a blog post explaining what prediction markets are, and why they stand to be much more than just digital casinos.

Prediction markets had a banner year in 2025. Both Kalshi and Polymarket are valued at over $10B. Robinhood has rolled out their own prediction market, as has DraftKings and FanDuel, with Coinbase’s expected to launch one soon too.

2026 is going to see prediction markets trading volume jump even further, and I expect Kalshi and Polymarket will raise at $20B+ valuations.

Two catalysts that I expect will drive this growth in 2026: The World Cup in North America this summer and the midterm elections in November.

Estimates range, but Polymarket and Kalshi are likely processing around $3B each per month today. By the end of 2026, I expect this number to at least double to $6B+ each.

8. Voice AI Reaches Mass Consumer Penetration

A few weeks ago over the holiday, I called my hotel's front desk for a room request. A voice answered, it was human-like, natural. It took me a few seconds to realize I was talking to an AI. It handled my request - sending up extra pillows to my room - without me ever speaking to a human.

By the end of 2026, most consumers will have a voice AI experience in which an AI agent handles a situation for them end-to-end, without the need for a human agent to intervene. Many consumers won’t even realize they were speaking with an AI.

Industries where humans are used to waiting on hold - airlines, hotels, events, home services - these will see the largest benefit of using voice AI. Legacy if-this/then-that voice bots with rigid menus and long hold times are costing enterprises billions in operational waste and consumer trust. Modern voice AI agents detect tone, handle multi-intent queries, and resolve complex issues in real time. They will allow companies to recoup lost revenue, reduce human-supported call volume, and improve customer support experiences.

9. 2026 IPOs will disappoint

While many expect 2026 to be a hot market for IPOs, I expect many of the most in-demand privately held companies will hold off on going public. This runs counter to the view held by public market investors, who in the survey below from Wolfe Research, overwhelmingly stated they expect the IPO market to return in 2026.

The below chart is from Setter Capital, a secondaries platform that helps connect buyers and sellers of privately held stock in hot companies like SpaceX and OpenAI. They publish a quarterly list of the top 30 most in-demand startups among private investors.

From this list, I expect 3-5 companies will go public in 2026, with the most likely in my opinion being Canva, Databricks, Kraken, Revolut, and - for a dark horse pick - Notion.

The AI labs have too much business model uncertainty and capex intensity to go public, and ditto for the hardware companies on the above list. AI applications like Lovable, Replit, and Glean are still in hyper-growth mode - early in business-building and reinvesting cash internally. Same goes for the prediction markets.

But here is the bigger point: private investors have built a shadow public market for these companies.

These companies’ shares trade with regularity across secondary markets and via tender offers whereby the company organizes a sale of employee and investor stock to other investors (or buys the stock back itself). Removing the need to provide liquidity to employees and shareholders reduces the incentive to go public. And for the top companies, the demand for their shares outstrips the supply available, creating a premium for their shares and liquidity practically as often as they could want it.

Until there is an overhaul of the regulations that govern public companies, it’s unlikely for this situation to change. Or put another way, expect the market for IPOs to disappoint in 2026.

10. M&A Stays Hot in Software & AI

2025 was a big year for software M&A. Just in December, major deals like ServiceNow’s acquisition of Armis and IBM’s acquisition of Confluent were announced.

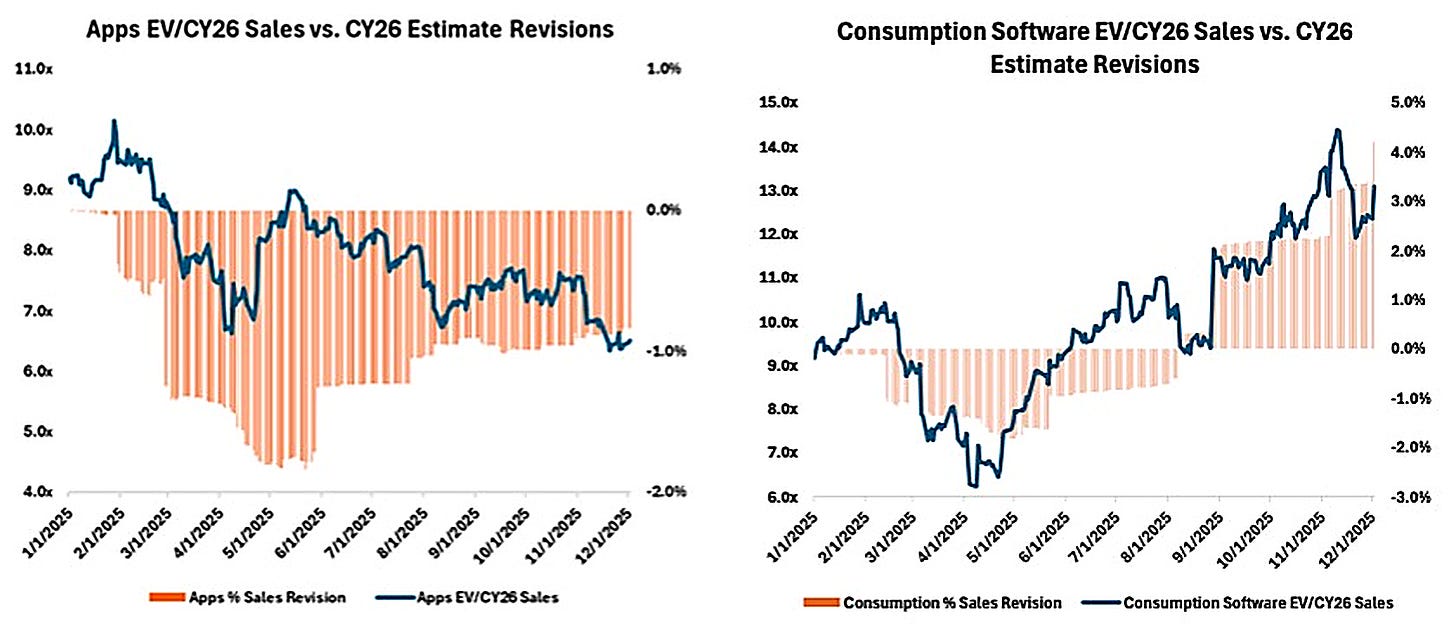

Major software companies across categories from cybersecurity (CyberArk, SolarWinds), payroll (Dayforce, Paycor), and infrastructure software (Confluent, Couchbase, Informatica) were taken out of the public markets by strategic and private equity acquirers.

In the chart below, I highlight the most significant acquisitions of public software companies. The median EV-to-revenue take-out multiple was 5.5x, with the median forward-year growth rate being 11% Y/Y.

Looking ahead to 2026, which public companies are most likely to be acquired?

The factors I look for are 1) companies that are being persistently undervalued by the market relative to peers, 2) a product suite that is potentially strategic or has increased monetization potential inside of another platform, and 3) single vs dual share class structures that can make an acquisition less likely if the controlling shareholder (founder) doesn’t want it.

For 2026, GitLab, SentinelOne, Okta, ZoomInfo, and Monday.com are my top 5 picks for public software companies most likely to get acquired. Each one has a large customer base, strong brand, and product that can be upsold or made more valuable by being bundled into a larger platform’s suite. They all trade below 5x forward revenue. In the cases of GitLab and Monday.com, I believe the market is undervaluing the tailwinds that AI could end up being for these businesses. That said, other than ZoomInfo, they all have dual-class share structures, which means that if the founder who has the controlling shares doesn’t want to sell, then there won’t be a sale.

What about acquisitions of private companies?

2025 saw the largest acquisition of a venture-backed software startup ever with Wiz getting taken out by Google for $32B. ServiceNow acquired both Armis for $7.75B and MoveWorks for $2.85B. There were plenty of other smaller but still notable deals like Salesforce’s acquisition of Qualified, Palo Alto acquiring Chronosphere and Protect AI, and many others.

For 2026, acquisitions of private companies will continue, but they will not be of the hottest AI-native companies. Most acquisitions will center on companies that reached $10M+ ARR prior to the AI wave, are growing 30%+, have demonstrated AI tailwinds, and provide a product expansion story to their acquirer.

As for the hottest, highest flying AI-native companies, there will be only a handful of M&A events in 2026. Manus, the AI agent company that sold to Meta for $2B last month, is the rare example here. The AI super-cycle is running red hot and private capital is cheap for companies that are growing. For companies whose growth stalls, many have raised enough capital to grind it out before selling. Check back here in 2027.

Lastly, don’t forget about the IP Licensing Deals, which allow the acquirer to license the IP and hire key leaders of companies without actually acquiring them. The 7 deals that have taken place with this structure have been the dominant form of M&A by big tech companies, including:

Groq acquired by Nvidia ($20B)

Scale AI acquired by Meta ($14.3B for 49%)

Character AI acquired by Google ($2.7B)

Windsurf acquired by Google ($2.4B)

Inflection AI acquired by Microsoft ($650M)

Adept acquired by Amazon (~$400M)

Covariant acquired by Amazon (~$380M)

And IP licensing deals will continue to dominate big tech M&A going forward, as they provide cover from the watchful eye of anti-trust regulators. I expect we’ll see more of these, especially in AI infrastructure - where regulatory scrutiny is highest today.

A Final Note on the Year Ahead

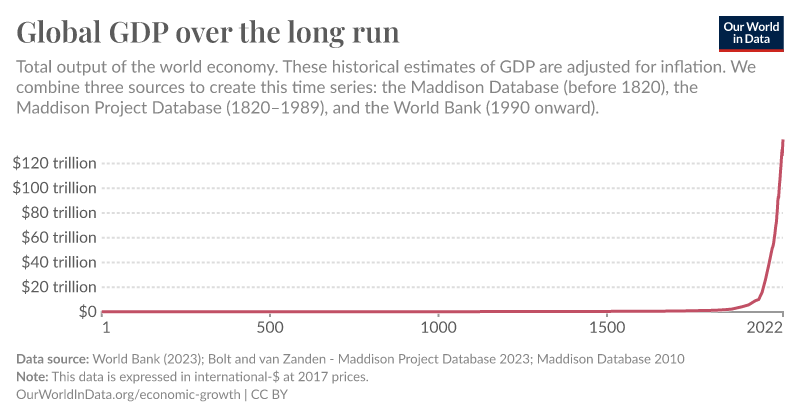

Below is one of my favorite charts of all time. It shows estimated global GDP over the past 2,000 years. From Rome to the Renaissance, it’s basically flat, driven by centuries of zero-sum survival and subsistence living. The industrial revolution hits, GDP goes vertical, and it hasn’t stopped since.

We live in an age of social media, deep political partisanship, a shifting global order, culture wars, and the 24-hour news cycle. In short: chaos. It’s easy to forget that we’re also living on an exponential curve of technological progress and economic growth.

Economic output is the closest thing we have to a long-term scorecard for civilization’s capacity to improve living standards. And the score keeps going up. The turbulence we feel isn’t happening in spite of the curve, but rather it’s a consequence of it.

So if the world feels like it’s getting weirder, faster - that’s because it is. But it’s also getting better.

Personalized healthcare and bespoke education. Robots that assist with elder care, household tasks, and menial work - freeing up time for humans to pursue their work and passions. AI that catches disease before symptoms appear. Real-time translation that erases language barriers. Autonomous cars that reduce traffic fatalities. Cheap, abundant energy.

These are shifting from science fiction to reality, and while they may not be on my list of predictions for 2026, they are for 2046.

The internet has trained us to focus on the news of the day, but history rewards those who bet on compounding.

So don’t get lost in the noise, and remember the line is still going up. Happy new year!